Revolut Is About to Break a UK Banking Record...

Hey Digital Banking Fanatic!

Revolut is just weeks away from breaking a UK record: the longest mobilisation period ever for a newly licensed bank.

It’s been 18 months since Revolut received its UK banking license and entered mobilization. In less than three weeks, it will officially surpass the current record.

This isn’t business as usual. Revolut is going through what many see as the most stringent bank authorization process the UK has ever applied, under a framework designed for a very different era of banking...

From the regulator’s perspective, the incentives are clear. There’s no upside if everything goes smoothly, but a massive downside if something goes wrong. That dynamic rarely leads to speed.

Still, letting Revolut fail at this stage isn’t an easy option either, especially for the Bank of England. Too much time. Too much scrutiny. Too much at stake.

The path here feels narrow, but forward. One way or another, Revolut is heading toward a full UK banking licence.

If you’re tracking how Digital Banking is colliding in real time, keep scrolling 👇I'll be back tomorrow with more updates.

Cheers,

INSIGHTS

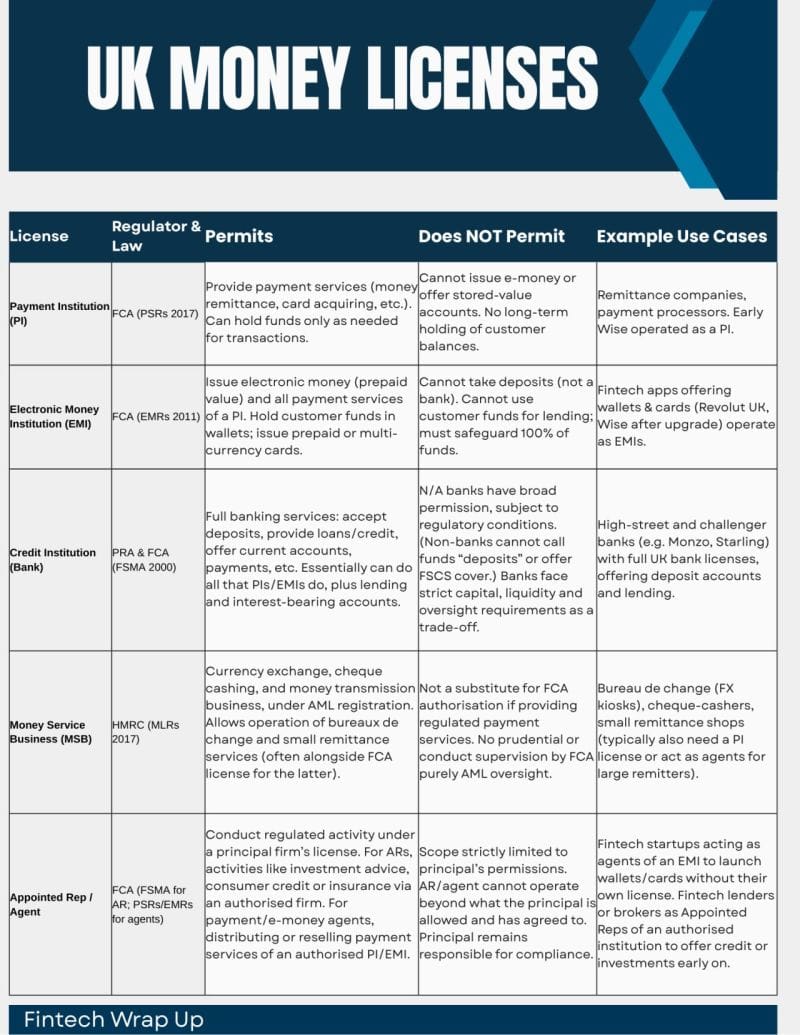

🇬🇧 Structuring your UK licence strategy 👇

NEWS

🇦🇪 Revolut prepares to offer crypto services in the UAE. This comes months after it received its in-principle approval for Stored Value Facilities and Retail Payment Services licenses from the Central Bank of the UAE. Continue reading

🇪🇺 Monzo pumped €71m into Irish unit in successful bid for EU banking licence. Authorisation from the Central Bank of Ireland and the European Central Bank allows Monzo to passport services across the EU, supporting its European expansion plans despite recent leadership changes at the group level.

🇺🇸 Interactive Brokers signals Irish banking licence interest. CEO Milan Galik said a European licence would bring benefits, following the firm’s recent application for a national trust bank charter in the US. Keep reading

🇦🇪 UAE's Wio Bank inks partnership with Global FinTech Pine Labs to modernise merchant acquiring infrastructure. The collaboration is going to build a modern acquiring infrastructure for Wio Bank with no legacy tech dependency, enabling faster merchant onboarding, real-time settlement capabilities, and seamless multi-mode payment acceptance at scale.

🇬🇧 Amazon Web Services extends Nationwide partnership to power digital banking transformation. The partnership will enable the building society to accelerate innovation and deliver more personalised experiences to its 17 million customers whilst maintaining "industry-leading" security standards.

🇸🇦 Ripple signs MOU with Jeel, Riyadh Bank’s innovation arm for blockchain solutions. Ripple and Jeel plan to develop several financial technology applications under the agreement, including cross-border payments and digital asset custody. Keep reading

🇧🇷 Lerian, a core banking firm, raises US$5.5 million to beat Visa's Pismo. The funding will increase investment in technology and staff so the startup can compete with giants like Pismo and Matera. Keep reading

🇧🇷 Nubank will invest more than R$ 2.5 billion over five years in office expansion for a new phase of growth. This movement reinforces the company’s commitment to development and innovation in the country. This movement accompanies the announcement of the new hybrid work model, which starts in July 2026, when around 70% of employees should work in the office two days a week.

🇨🇭 Yuh becomes the main partner of the BSC Young Boys men’s team. The move builds on the existing relationship between the two organisations. Partnership expands from the 2026/27 season, building on existing support for the YB women’s team.

🇧🇷 DólarApp wants to expand in Brazil. The FinTech aims to serve the Latin American public that uses stablecoins for international transfers and payments, charging a total fee of 0.5% on the transaction. Currently, it has almost two million users in Mexico, Argentina, and Colombia.

🇦🇺 Australian digital bank in1bank to cease operations. The bank says customers have until 4th February 2026 to transfer remaining balances to alternate bank accounts, adding on its website: "Please note that the in1bank app will no longer be in service, effective at 5 pm AEDT on 5th February 2026."

🇸🇬 Fingular announces SGD 10 million debt financing round. The financing marks an important milestone in the company’s growth strategy and will support further scaling in Malaysia. The deal was structured via Kilde, a licensed platform connecting family offices, funds, and accredited investors to private credit opportunities across Europe and Asia.

🇨🇦 Float lands $100m to scale business banking. The non-dilutive capital will allow Float to expand its high-yield business accounts and scale its Charge working capital product for Canadian businesses. It will also use the funding to scale Charge, extending flexible working capital to thousands more businesses and unlocking more than $1.5 billion in annualised spending power.

🇫🇷 French FinTech Quideos invests in agricultural hedging and receives R$ 28.6 million. Quideos aims to expand the scale of its agricultural product price protection solution, with the goal of safeguarding industry players against market volatility.

🇦🇺 Perth FinTech Miconex appoints Idong Usoro as new Chief Digital Officer. Idong will lead on driving digital maturity, investment, and operational transformation at the Perth-based FinTech, following 7 years of supporting Miconex in a strategic advisory capacity.

🇺🇸 Mine is announcing a $14 million in funding in a 359 Capital-led Series A. Mine offers a debit-like card that helps users build credit without overspending, alongside an AI-powered financial advice app called MoneyGPT. Continue reading

Want your message in front of 100.000+ Digital Banking fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.