Revolut Plans Mexico Banking Rollout in 2025

Hey Digital Banking Fanatic!

Revolut is preparing to launch full banking operations in Mexico by the second half of 2025. With its banking license secured from the Comisión Nacional Bancaria y de Valores (CNBV) in April 2024, only final regulatory approvals stand between the company and its official debut.

“We are in the final stages,” said Juan Guerra, CEO of Revolut México, in an interview during the 88th Banking Convention. His words hint at cautious optimism as the firm undergoes regulatory audits designed to verify operational readiness. Nearly 200,000 users are already on the waiting list, with projections of up to 1.5 million in its first year.

Revolut enters a market that is growing more competitive, not only with established local players but also with international names like Wise and Openbank, both announced this year. But, perhaps the most significant is Nubank.

Three weeks ago, Nubank, the largest digital bank in Latin America, secured a full banking license in Mexico, where it already serves over 10 million customers. After investing more than $1.4 billion in the country, Nubank is set to broaden its product offering beyond its Sofipo operations, raising the stakes in digital banking services.

Revolut’s first offer in Mexico is expected to be a multi-functional account, designed to manage shared expenses, foreign currencies, and instant international transfers, all aimed at the vast remittance corridor between Mexico and the United States. “Free instant transfers are not our business. Our business is an integral relationship with the client,” Guerra noted. The move is part of Revolut’s broader goal to reach 100 million daily active users in over 100 countries.

Read all the other Digital Banking industry news below 👇 and I'll be back with more tomorrow!

Cheers,

INSIGHTS

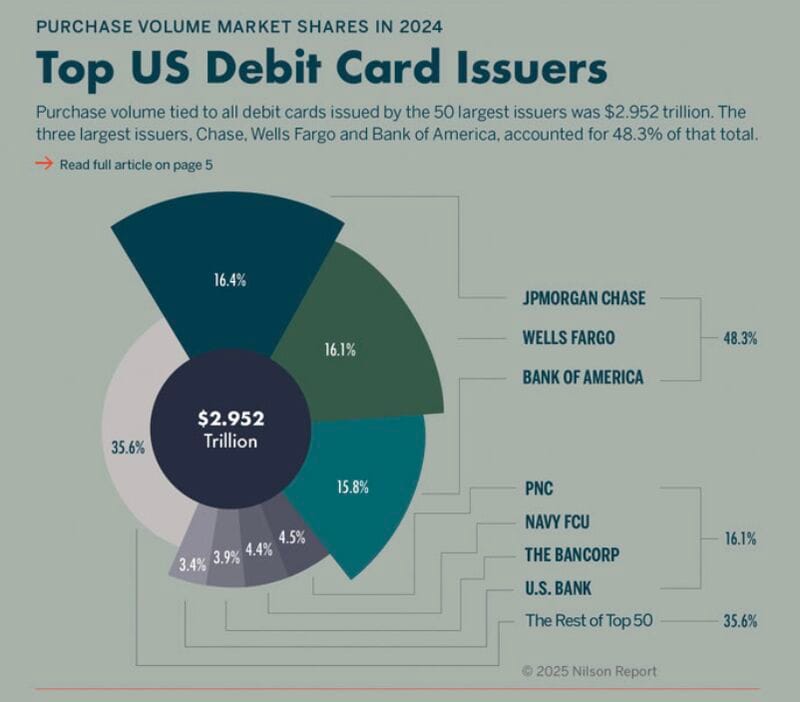

🇺🇸 Purchase volume tied to all debit cards issued by the 50 largest issuers in the US was🇺🇸 $2.952 trillion.

DIGITAL BANKING NEWS

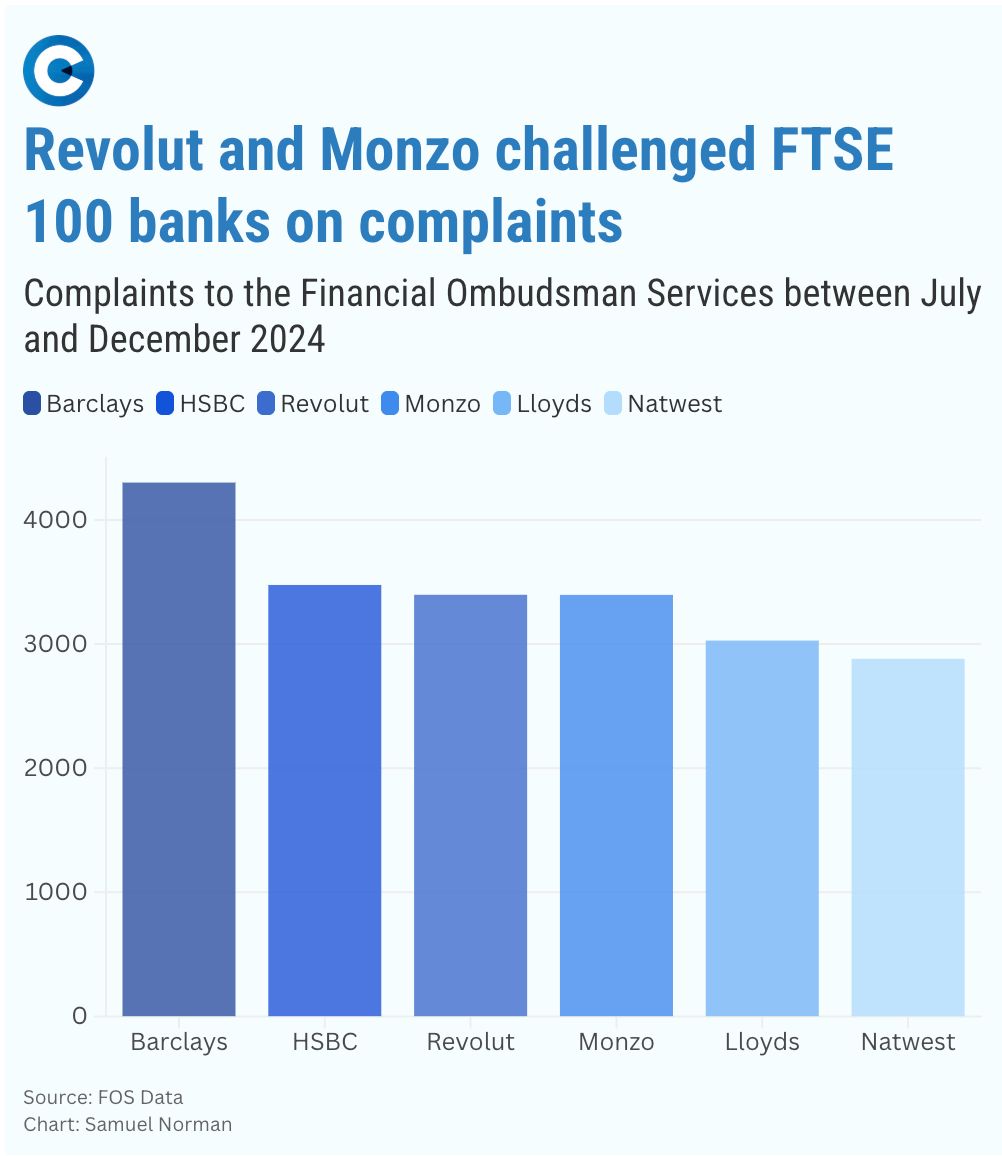

🇬🇧 Revolut, Monzo, and Wise: The UK FinTechs slapped with the most complaints.

🇲🇽 Revolut expects to start operations as a bank in Mexico in the second half of 2025. The company received approval from Mexico's National Banking and Securities Commission, allowing it to establish a multiple banking institution, Revolut Bank, with a capital of 1.43 billion pesos. The bank's headquarters will be in Mexico City.

🇺🇸 FinTech Firm Chime signs 84K-SF lease at 122 Fifth Avenue. San Francisco-based Chime signed an 84,000-square-foot lease for space in the property five blocks south of the Flatiron Building, where it will move its New York City offices from 101 Greenwich Street.

🇪🇹 Safaricom to launch credit, savings products to boost M-PESA in Ethiopia. Ethiopia is opening up its financial sector, and Safaricom is betting this will pay off. The country licensed its first two investment banks in April 2025 and launched its securities exchange two months earlier.

🇨🇭 Swissquote seeks to shake crypto link despite 1,500% stock rally. Swissquote co-founder and CEO Marc Buerki stated that the company does not consider itself a "Bitcoin stock." However, he acknowledged that some investors may primarily associate Swissquote with its cryptocurrency business.

🇦🇹 DenizBank partners with Konsentus to enhance open banking operations. This collaboration aims to ensure compliance with regulations, improve operational efficiency, and enhance security within its digital banking landscape. DenizBank provides a variety of retail and commercial banking services.

🇬🇧 Major change to customers of 30 UK banks after new Post Office deal. Millions of bank customers can access their money at Post Office branches. The five-year deal secures the role of postmasters up and down the country in providing banking services to their communities.

Want your message in front of 100.000+ Digital Banking fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.