Revolut Quietly Advances Stablecoin Plans

Hey Digital Banking Fanatic!

The stablecoin conversation isn’t going away... and in FinTech, it’s becoming harder to ignore. Revolut hasn’t shelved its plans. In fact, the neobank is now moving forward with advanced efforts to issue its stablecoin.

The neobank has been working on the project since at least early 2024, according to people familiar with the matter. It’s seen as a step to expand the company’s crypto footprint, which already includes Revolut X, a centralized exchange rolled out last year across the EU.

Back in December, sources told Sifted that the stablecoin effort had been delayed by internal red tape and regulatory uncertainty. Now, other sources say Revolut remains committed and is in active discussions with at least one crypto-native partner to help bring the stablecoin to market.

Meanwhile, stablecoins continue to gain traction beyond crypto circles. Last month, U.S. banking giants, including J.P. Morgan, Bank of America, Citi, and Wells Fargo, entered early discussions about developing a joint USD stablecoin, alongside payments networks like Zelle and The Clearing House.

More recently, the giant retailers Walmart and Amazon have also begun exploring USD-backed stablecoins of their own, reportedly to cut banking fees and simplify transactions. And just last week, Coinbase rolled out a tool that allows merchants to accept stablecoin payments without handling crypto directly, already live on Shopify.

Revolut has not officially confirmed the stablecoin project. But in a statement to CoinDesk, a company spokesperson said: “Crypto is a big part of our belief in banking without borders, and we have a clear mission to become the safest and most accessible provider of crypto asset services.”

Will Revolut move ahead before the year ends, or wait until 2026?

Read all the other Digital Banking industry news below 👇 and I'll be back with more tomorrow!

Cheers,

INSIGHTS

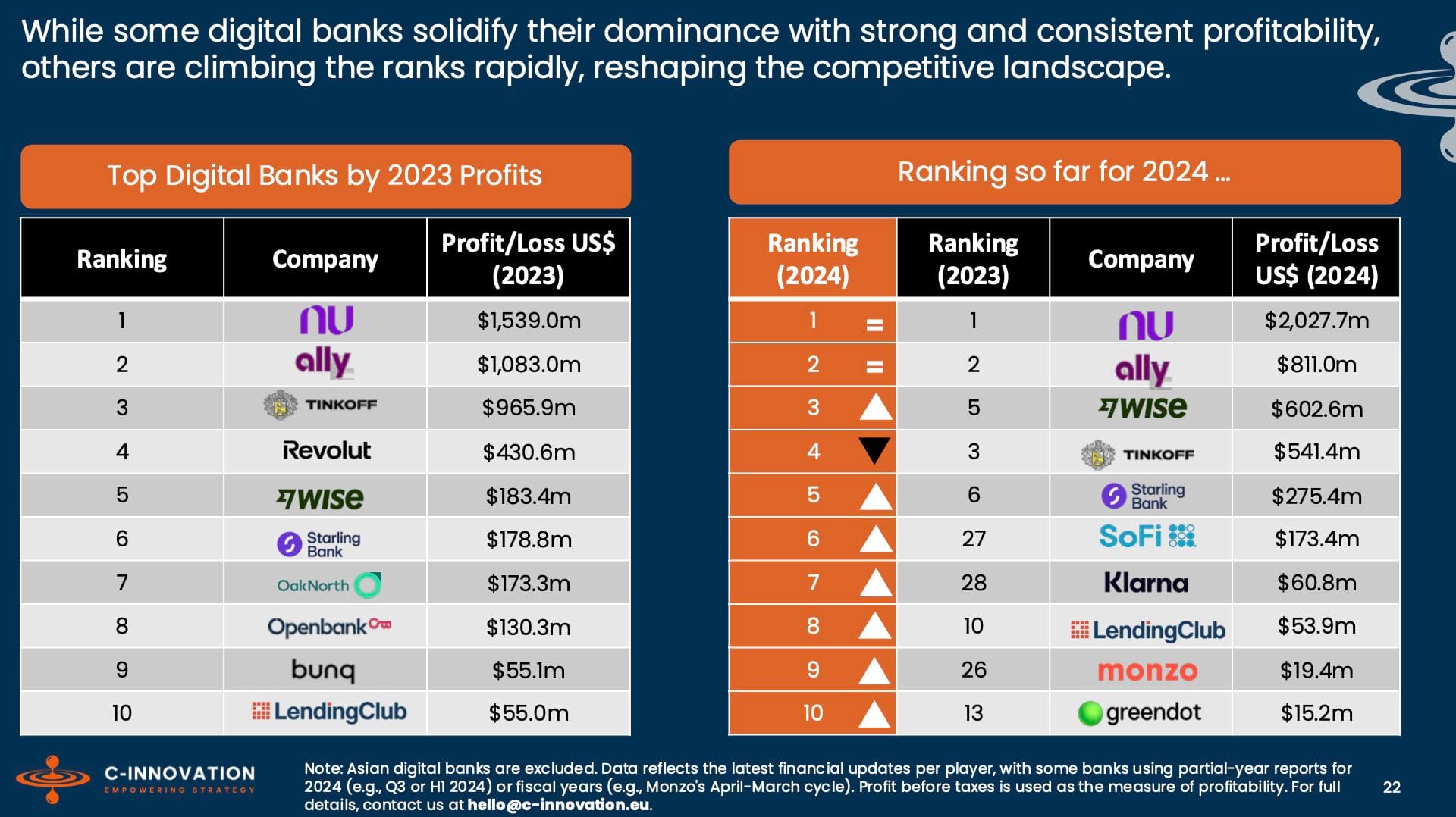

📊 Here's a list of the Top 10 Digital Banks ranked by profit.

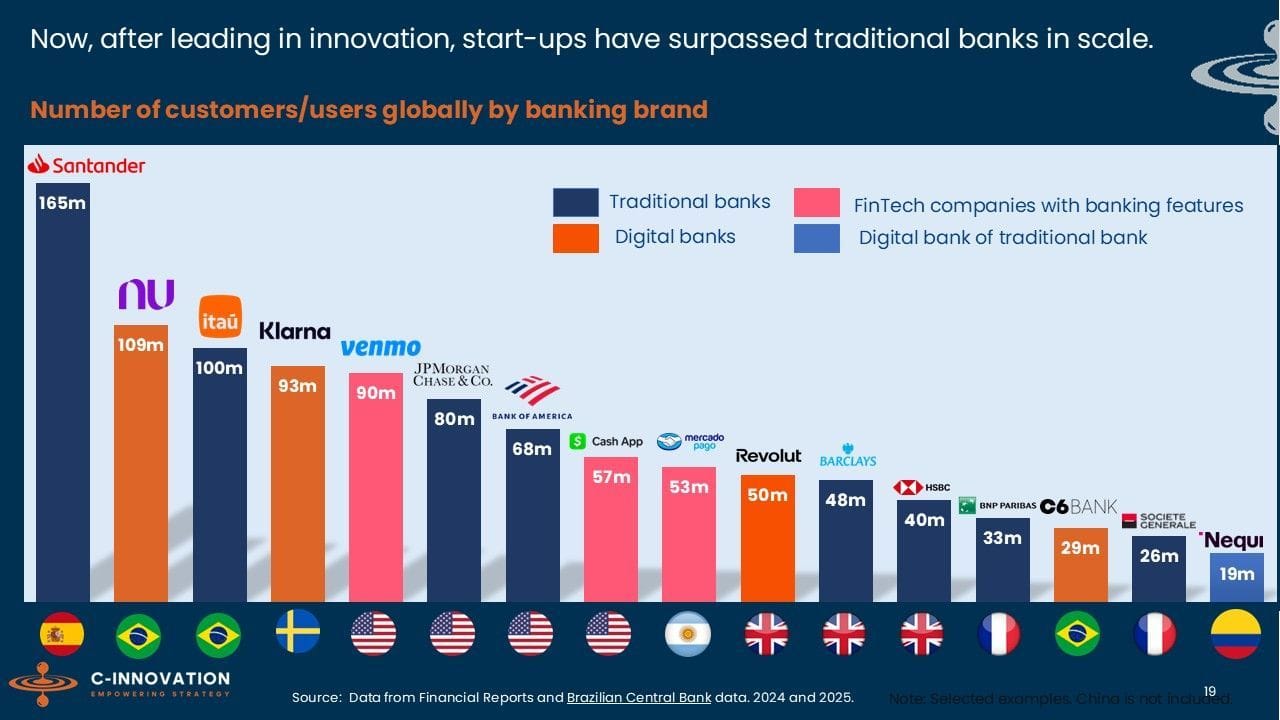

📈 Revolut is acquiring 40k new users A DAY.

NEWS

🇬🇧 Neobank Revolut is actively exploring launching its stablecoin. The development comes amid a growing list of non-crypto companies now considering issuing their stablecoins as the regulatory environment shifts in the United States and around the world.

🇭🇺 Revolut crackdown possible: government to tighten regulations on neobanks with new tax. The legislation would tighten the rules for paying the transaction fee and eliminate the loophole that neobanks have been able to rely on so far. According to the new definition, any operation that reduces the user's account balance may be subject to the fee, even if it is just an internal transfer.

🇦🇪 First Abu Dhabi Bank becomes the First MENA Bank to join CIPS as a direct participant. FAB’s direct participation in CIPS enhances its ability to provide clients with faster, more secure, and efficient cross-border RMB payment solutions, reinforcing its leadership in cash management and clearing across the MENA region.

🇷🇴 Salt Bank Appoints Vikram Tikoo as Chief Technology Officer. Vikram's main objective is to strengthen Salt Bank's strategic direction to enable rapid growth. In his new role, he will oversee the integration of advanced technologies to ensure the platform’s scalability and security while supporting the expansion of its product and service offerings.

Want your message in front of 100.000+ Digital Banking fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.