Revolut Seeks $1B at a $65B Valuation It Previously Rejected

Hey Digital Banking Fanatic!

It’s been a tough week to keep up with all of Revolut’s updates, from the Alipay partnership and Mubadala’s $100M investment, to the UK ISA launch and more… and it doesn’t seem to be slowing down!

According to the Financial Times, Revolut is reportedly now seeking to raise $1B at a $65B valuation. Interestingly, just 2 months after it was said to have turned down that same valuation... 🤔

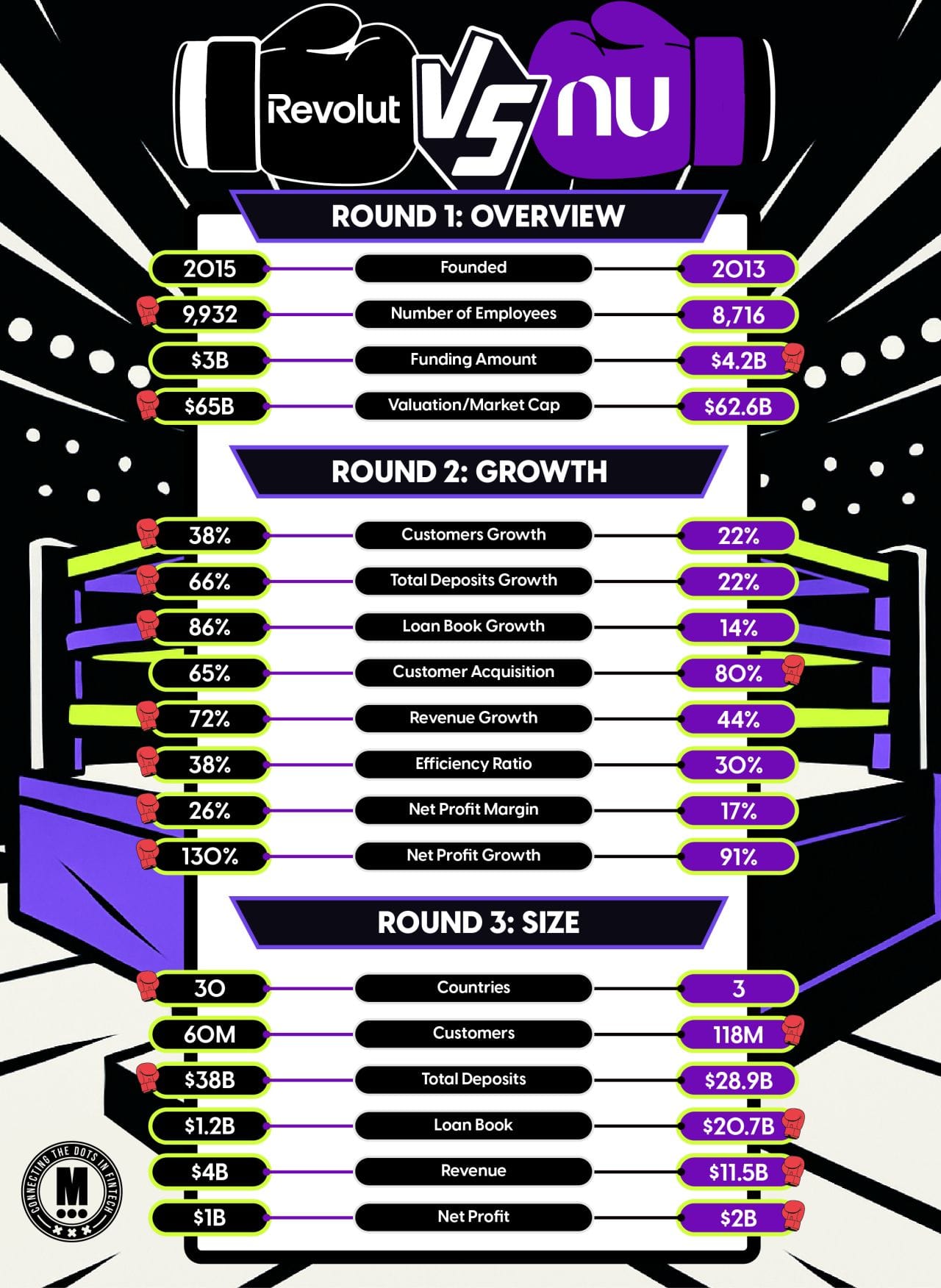

But that means it has now overtaken Nubank in valuation 🤯

A little treat for you, in case you'd like to see how Revolut compares to Nubank, we got it covered, so scroll down for more 👇

See you on Monday!

Cheers,

INSIGHTS

📈 Revolut’s new $65B valuation puts it above Nubank's valuation 🤯

Time for a comparison on Key Stats - Revolut 🆚 Nubank:

NEWS

🇮🇹 The Italian Competition Authority has opened an investigation into Revolut. Regarding investment services, Revolut allegedly promoted the option of investing in shares, highlighting the absence of commissions and failing to clarify the presence of additional costs and the limitations that characterize commission-free investments.

🇦🇺 MYOB moves into banking services with the launch of Solo Money. Solo Money will provide an all-in-one mobile solution for sole operators from day one, incorporating a transactional bank account with market-leading accounting software so they can stay on top of their finances.

🇺🇸 MANTL and the Alkami solution team offer Plaid Layer. Through this integration, MANTL empowers regional and community financial institutions to deliver the same seamless digital onboarding experiences as tech-first neobanks while unlocking faster growth and stronger conversion.

🇧🇷 Neon raises US$25 million from IFC and DEG. Jamil Marques, Neon's CFO and COO, said the funds will help Neon accelerate credit investments, with a focus on private payroll loans and technological development. Read more

🇬🇧 Flagstone to launch up to 10 Cash ISAs by January 2026. Simon Merchant, CEO of Flagstone, comments: “Our Cash ISA products will offer competitive tax-free rates to savers who deserve to be rewarded for taking action and trying their best to make their money work harder for them“.

Want your message in front of 100.000+ Digital Banking fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.