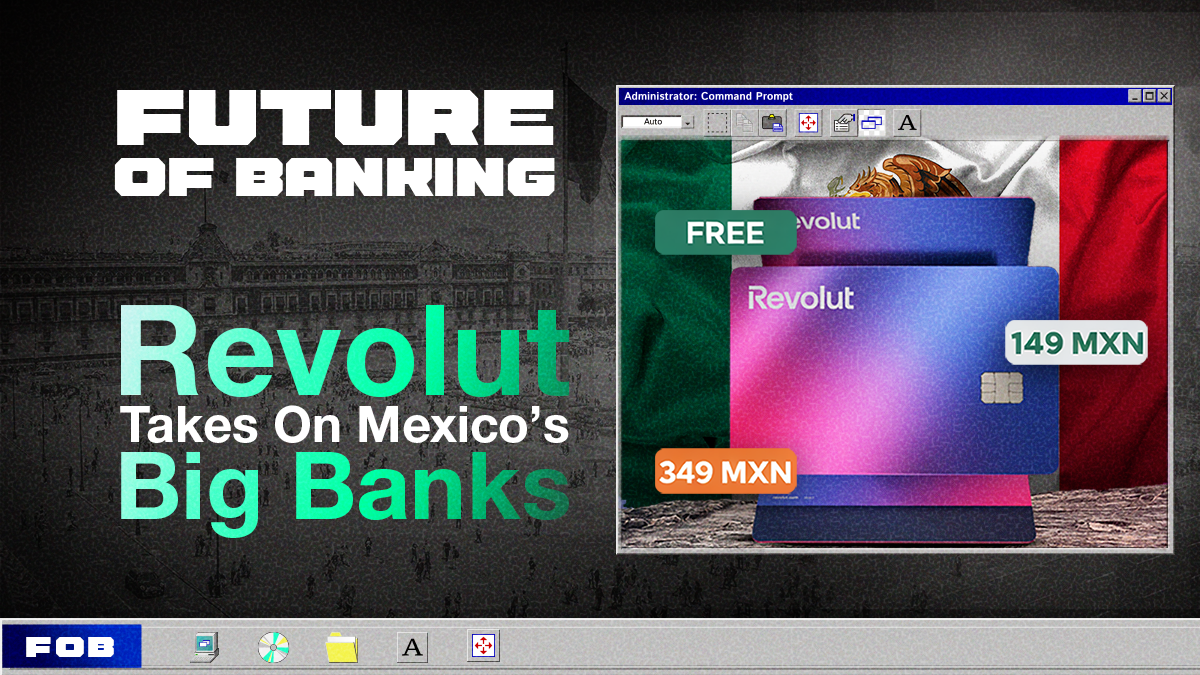

Revolut Takes On Mexico’s Credit Card Giants With A Perks-First Play

Hey Digital Banking Fanatic!

Revolut is stepping straight into Mexico’s credit card battlefield.

Just weeks after launching as a bank, the FinTech is rolling out its own credit card to take on BBVA, Banamex, HSBC, and Santander.

Early access invites are already going out. Three plans are on the table. One free. Two paid. All issued on Mastercard and bundled with perks that go beyond the usual cashback.

Think airport lounge access at Mexico City’s AICM. Think subscriptions like Tinder Gold and WeWork baked into the offering. Credit cards, but with a lifestyle angle.

Mexico is no side market here. Revolut has been clear that the country is a key testing ground for its global ambitions, backed by an initial investment of 1.8 billion pesos, its largest outside Europe.

The timing is bold. More than 40 million credit cards are already in circulation, dominated by local and international incumbents.

At its core, this is less about launching another card and more about redefining how credit competes in one of LatAm’s toughest markets.

If you’re watching how Digital Banking players are going head-to-head with incumbents, keep scrolling 👇 I'll be back in your inbox next week.

Cheers,

Want your message in front of 275.000+ FinTech fanatics, founders, investors, and operators?

NEWS

🇪🇸 Revolut reaches six million customers in Spain, positioning itself as the fourth largest bank in the country by market penetration with a 13% share, ahead of institutions such as Sabadell and ING. This was announced by the company in a press release.

🇵🇹 Revolut employees pressured with "unrealistic" metrics. The Union of Workers in Large Surface reported that it has received several complaints from employees of the digital bank, which employs around 1,200 people in the country, about abusive labor practices. Additionally, Revolut launches its credit card with Tinder and WeWork subscriptions. Revolut began sending early access invitations to this product to some customers, with three different offers.

🌍 Neil Budd appointed Finshape CEO. Neil Budd brings experience from Finshape competitors Accenture and Finastra, and will look to scale the company to Western Europe, the Middle East, and APAC as the new CEO. Read more

🇺🇸 Trump Crypto Venture World Liberty applies for Bank Charter. World Liberty Financial’s subsidiary WLTC Holdings has lodged a “de novo” application with the US Office of the Comptroller of the Currency (OCC) for a national trust bank charter.

🇺🇸 Morgan Stanley to launch digital wallet for tokenized assets by 2026. The wallet will support tokenized assets such as traditional investments and private-company equity. Bitcoin, Ether, and Solana trading will also be introduced via E*Trade in early 2026.

🇲🇽 Open Finance takes the CNBV to court. Open Finance is a fundamental link in financial inclusion. By interconnecting not only banking data but also multiple universes of information, it allows for the creation of products and services tailored to each individual.

Want your message in front of 100.000+ Digital Banking fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.