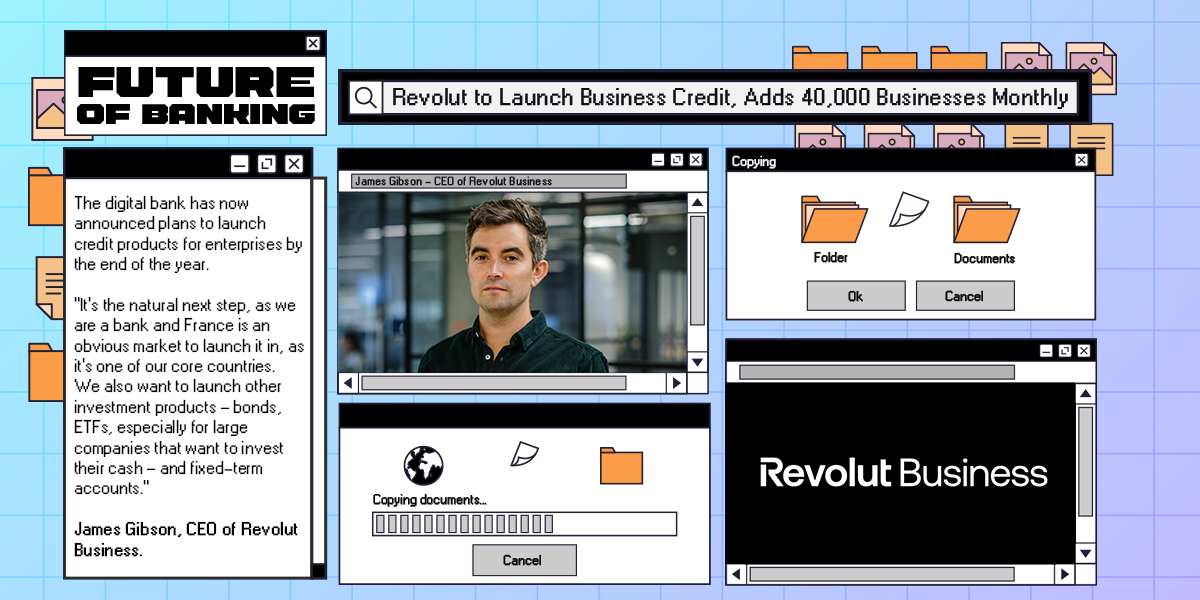

Revolut to Launch Business Credit, Adds 40,000 Businesses Monthly

Hey Digital Banking Fanatic!

Two years after Revolut’s launch, its Business segment quietly emerged in 2017 and has steadily become a core part of the bank’s operations. Today, Revolut Business contributes 15% of total revenue, attracts 40,000 new business customers each month, and serves “hundreds of thousands of business customers.”

The digital bank has now announced plans to launch credit products for enterprises by the end of the year. “It’s the natural next step, as we are a bank and France is an obvious market to launch it in, as it’s one of our core countries. We also want to launch other investment products – bonds, ETFs, especially for large companies that want to invest their cash, and fixed-term accounts,” said James Gibson, CEO of Revolut Business.

This comes after Revolut Business launched its new savings account last week in France, the Netherlands, Ireland, and Lithuania, offering daily interest of up to 2%. Revolut Business's goal is to give businesses alternatives to leaving funds idle or moving them into riskier products. “These rates are among the best on the market,” said Gibson, highlighting the account’s role in keeping business capital both active and secure.

As competition intensifies — with Qonto, Memo Bank, and Vivid expanding rapidly — Revolut is fine-tuning its local offering. Features like French IBANs, SEPA B2B direct debits, payment terminals, and new accounting integrations are designed to meet the evolving needs of businesses on the ground.

Read all the other Digital Banking industry news below 👇 and I'll be back with more tomorrow!

Cheers,

Stay ahead in the US FinTech revolution. Subscribe now for weekly insights delivered straight to your inbox.

DIGITAL BANKING NEWS

🌍 Revolut Business announced the launch of a high-yield savings account offering up to 2% interest in four countries: France, the Netherlands, Ireland, and Lithuania. According to James Gibson, CEO of Revolut Business, credit products, term deposits, and investment options like bonds and ETFs are also on the way later this year.

🇦🇺 ANZ to support password-free web banking from mid-2025. Users will authenticate their identity through two methods, including a passkey, which may include biometric options such as fingerprints or facial recognition, or by entering their mobile number and approving a login request via the ANZ Plus app.

🇫🇷 BNP Paribas renews IBM partnership, unveils new cloud infrastructure for 2028. The expansion will further bolster BNP Paribas’ ability to manage risks associated with cloud service providers, a priority area under DORA. Continue reading

🇵🇱 Santander raises €7bn from Poland sale. The Spanish bank’s move comes amid questions about whether its sprawling global presence, in which it has described Poland as one of its 10 “core markets”, still makes sense. Keep reading

🇧🇷 Magalu has appointed Jorg Friedemann as the new CEO of MagaluBank, its financial services division. This strategic move aims to accelerate the growth of Magalu's financial services, particularly in digital channels, where the company sees significant untapped potential.

🇩🇪 PayPal announces plans to revolutionize in-store payments in Germany. The new contactless feature will be accessible through the latest version of the popular PayPal App (both iOS and Android). Consumers will be able to choose PayPal to pay safely and easily with a simple tap of their phone at any location that accepts Mastercard contactless payments.

Want your message in front of 100.000+ Digital Banking fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.