Revolut’s $1.4B Q2 Revenue 🤯

Hey Digital Banking Fanatic!

🚨 Big number alert: Revolut just posted $1.4 billion in revenue in Q2 — nearly doubling from the same period last year 🤯.

According to investor docs seen by Bloomberg, July alone brought in £373M, followed by £410M in August. That kind of pace puts Revolut on track for £4.1B+ in annual revenue, up from £3.1B in 2024 (when it also booked a record £1.1B pretax profit).

These numbers surfaced as the company is out pitching investors for its next funding round… which brings me to today’s quiz 👇

👉 At what valuation is Revolut working on this fundraise?

A) $45B

B) $60B

C) $75B

D) $100B

You can check the right answer here — and let me know if you nailed it 😉

Cheers,

INSIGHTS

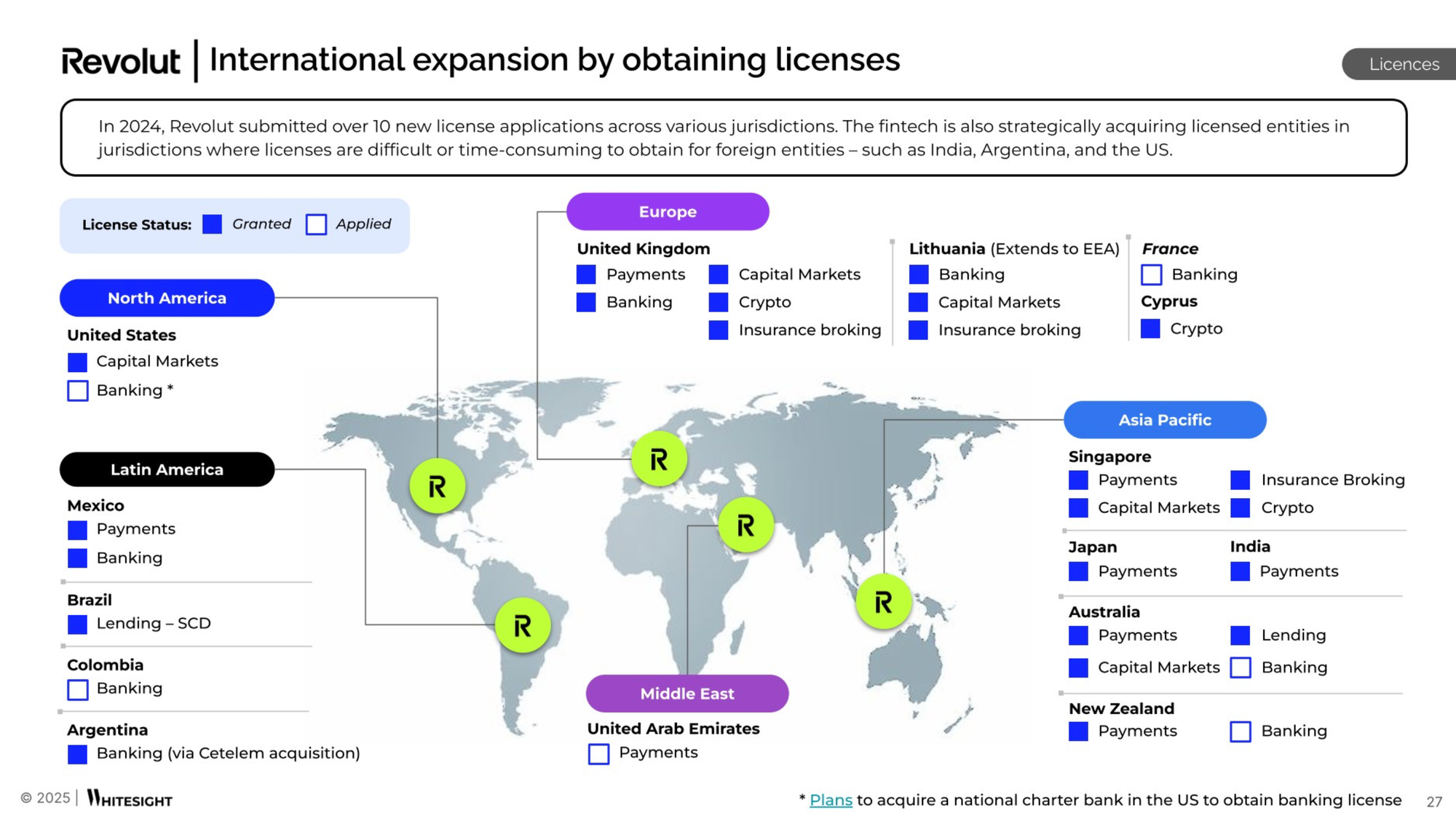

🌍 Revolut isn’t just expanding… It’s collecting licenses like trophies.

NEWS

🇪🇺 EU stress test reveals why resilience demands infrastructure reform by Richard Albery and Jeremy McDougall from ACI Worldwide. Stress tests may be hypothetical exercises, but they reveal very social truths: how institutions behave under pressure, where systems and operating models break, and what continuance really looks like. Keep reading

🇬🇧 Revolut touts $1.4 billion revenue haul as it courts investors. The results show that Revolut has continued to rapidly grow its revenue as it expanded to new markets and amassed more than 60 million customers around the world. Keep reading

🇺🇸 The US is a "priority" for Revolut Business, says its GM James Gibson. Over 500,000 businesses are using Revolut Business, which, at its core, offers local and international money payments, FX, and spend management features- though the product offering is tailored to different markets.

🇦🇺 Westpac taps Mastercard and Oracle's new embedded virtual card payment capabilities. By embedding virtual cards directly into the Oracle Cloud ERP, businesses gain real-time visibility, enhanced control, improved working capital management, and streamlined supplier onboarding, all within their system of record.

🇩🇪 Openbank launches cryptocurrency trading service. Customers in Germany will be able to buy, sell, and hold Bitcoin, Ether, Litecoin, Polygon, and Cardano alongside their other investments. Over the coming months, Openbank will expand its portfolio of available cryptocurrencies and will offer new functionalities such as conversion between different cryptocurrencies.

🇮🇱 Israeli digital bank Esh launches with no fees. The bank is offering customers no fees on a checking account and 50% of the income it generates from customers' money. The bank plans to take advantage of its low operating costs to distribute half of the income it generates from its current operations and deposit it in customer accounts.

🇬🇧 Starling reveals new-look logo, app, and cards. The updates support Starling’s mission to help people in the UK be ‘Good with money,’ with every aspect of the bank’s visual identity, app, and customer experience designed to encourage customers to take action over their finances, and to rethink how they budget, spend, and save.

🇫🇷 UK digital bank Tide is launching in France. Starting with its Partner Credit Services (PCS) offering, the company plans to gradually expand its services to support French SMEs with a comprehensive financial platform designed to save both time and money.

🇰🇷 K bank proves stablecoin remittance technology between South Korea and Japan. The internet-only K bank said that it has completed the first phase of verification of "Project Pax," a proof-of-concept project for overseas remittance technology utilizing stablecoins between the two countries.

🇺🇸 JPMorganChase and Plaid announce an extension to their data access agreement for the sharing of consumer permissioned data. The agreement, which includes a pricing structure, outlines a series of commitments that JPMC and Plaid made to ensure that consumers can access their data safely, securely, quickly, and consistently into the future.

Want your message in front of 100.000+ Digital Banking fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.