Revolut’s UK Licence Faces New Hurdles as Wise Expands in the UAE

Hey Digital Banking Fanatic!

Revolut’s full UK banking licence is facing another delay, and regulators are not making it easy.

According to the Financial Times, the Bank of England’s Prudential Regulation Authority wants stronger proof that Revolut’s risk systems can keep up with its explosive growth. The company now serves 65 million users in 40 countries and is adding 1 million new customers every 17 days. 🤯

With plans to expand into 30 more countries by the end of the decade, and a long-awaited IPO on the horizon, this next regulatory milestone could define Revolut’s next chapter.

As Revolut’s lead regulator, the PRA was mindful that approving a full UK banking licence was likely to trigger a wave of similar accreditations in other countries that would follow its lead.

The process has now stretched beyond 14 months, making it the most complex mobilisation in UK history. CEO Nik Storonsky called it Revolut’s “number one priority” and admitted it was a mistake to expand globally before locking it down at home.

Regulators are being extra cautious, but there is also good news. Revolut just announced a very interesting acquisition. Scroll down to read more about it 👇

And speaking of licences, Wise just received full approval from the UAE Central Bank, marking its 70th global licence and clearing the path for a local launch.

Cheers,

INSIGHTS

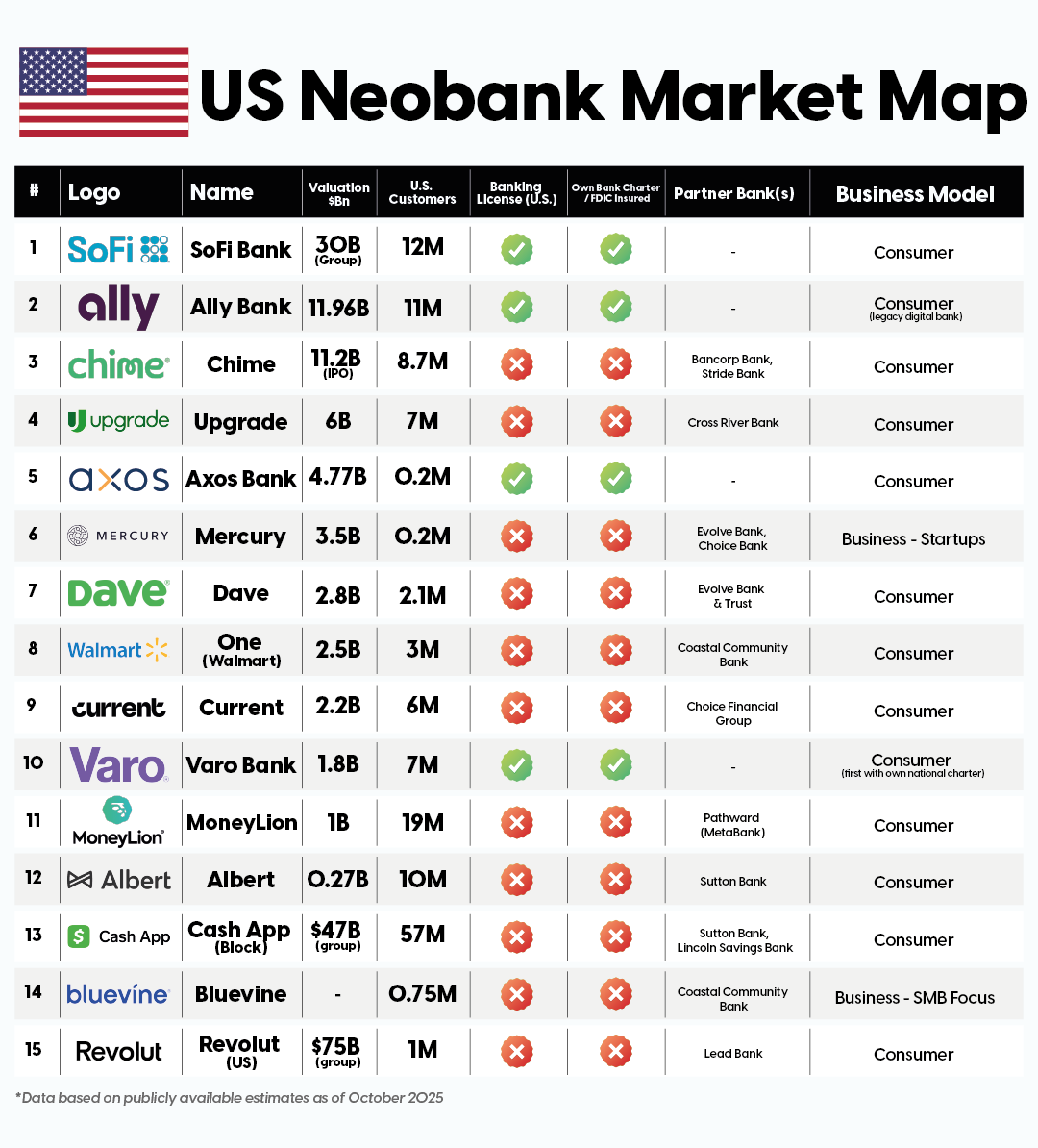

🇺🇸 How long before Revolut and Nubank crash this list?

NEWS

🇬🇧 Revolut’s full UK banking licence held up by concerns over global risk controls. Revolut was approved for a UK banking licence in July 2024 after a three-year wrangle with regulators, but remains subject to restrictions during a mobilisation phase. A full banking licence would allow Revolut to enter the lucrative UK lending market, putting to work its significant customer deposits.

🇩🇪 Revolut acquires AI travel agent startup Swifty, incubated at Lufthansa Innovation Hub. This acquisition complements Revolut’s development of its AI financial assistant, building on the lifestyle offering. Swifty's AI agent is designed to autonomously handle the entire travel booking process through a simple conversational interface.

🇦🇪 Wise secures final approval from the Central Bank for stored value facilities and retail payment services licenses in the UAE. Wise has received licence approvals from the Central Bank of the UAE for Stored Value Facilities and Retail Payment Services, marking a key milestone in its plans to expand services to personal and business customers.

🇺🇸 Bridge, a subsidiary of Stripe, has applied to the Office of the Comptroller of the Currency for a charter to become a national trust bank. This move would enable Bridge to operate under a unified federal framework aligned with the GENIUS Act. If approved, the bank would offer services including custody, stablecoin issuance, and management of stablecoin reserves.

🇱🇹 Tide establishes tech centre in Lithuania to support global growth. Tide is planning to employ an additional 60 - 70 full-time professionals over the next 3 years, focusing on backend and mobile development in remote-first positions, with an office in Vilnius.

🇬🇧 Ruwani Hewa appointed director of payments at Starling Bank. Hewa says she will focus on the relaunch of Starling Banking Services as one of her initial priorities. She adds that this effort will look towards helping regulated firms access Faster Payments/Bacs and issue safeguarded and client money accounts under CASS.

🇬🇧 Shawbrook looks to raise over £50M in November IPO. The company is targeting a listing in early November 2025 and expects to raise £50m in net proceeds through new shares. The IPO will be offered to qualified institutional buyers internationally and to retail investors resident in the United Kingdom through a partner network with RetailBook.

🇩🇰 Lunar received a MiCA license for crypto services. With the new MiCA license, Lunar now operates under the EU’s first comprehensive regulatory framework for digital assets, offering users stronger protections, clearer rules, and a fully regulated crypto trading experience.

🇬🇧 Monzo simplifies Making Tax Digital with a built-in tax filing tool, powered by Sage. The tool is designed to help sole traders and landlords comply with the upcoming Making Tax Digital for Income Tax legislation. Also enables banks, FinTechs, and software platforms to seamlessly build accounting and other capabilities directly into their products.

🇩🇪 Salt Bank launches investment offering with Upvest. With Upvest’s Investment API, Salt Bank provides a fully integrated and seamless trading experience. The new service enables end users to buy and sell securities with transparent fees, directly within their mobile banking environment.

🇬🇧 Charity Bank to launch savings app powered by Sandstone Technology. According to Sandstone, the new offering will include enhanced self-service capabilities, robust security features, and a suite of modern tools designed to meet the evolving needs of Charity Bank’s customers and is expected to launch in Spring 2026.

Want your message in front of 100.000+ Digital Banking fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.