Riyadh Air and Mastercard Team Up to Redefine Travel from Day One

Hey Digital Banking Fanatic!

Riyadh Air and Mastercard just announced a deep strategic partnership that blends payments, travel, and technology into a single, digital-first ecosystem.

With no legacy systems to unwind, Riyadh Air gets to build from scratch. Branded Mastercard credit and prepaid cards are coming, fully embedded into the airline’s app, turning everyday spending into flights, upgrades, and premium experiences.

The cards are set to launch for Saudi residents in late 2026, alongside premium airport experiences and next-gen B2B travel payments. This isn’t just about loyalty. It’s about baking payments directly into how travel works.

The partnership allows Riyadh Air to roll out integrated payments, rewards, and virtual solutions all at once, something very few airlines ever get to do.

From Dimitrios Dosis’s side, this is about creating seamless, secure payments that add value across the entire travel journey, from consumers to airlines to hospitality partners...

If you’re watching how payments are quietly becoming core infrastructure for travel and aviation, keep scrolling 👇 More stories from the ecosystem coming your way tomorrow.

Cheers,

INSIGHTS

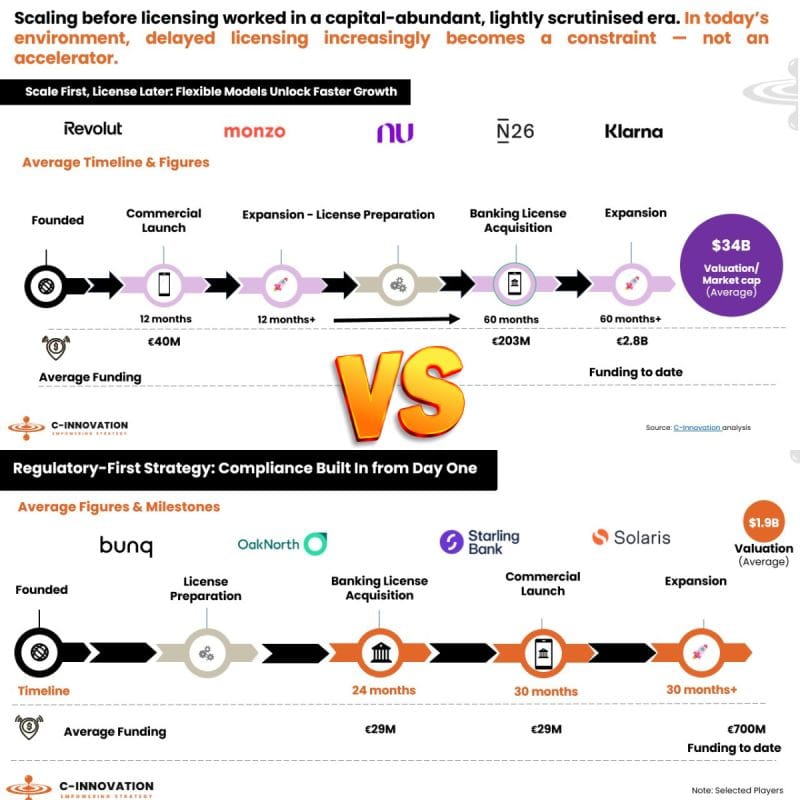

📈 “Scale first, license later” used to accelerate FinTech growth. Owning a licence allows FinTechs to launch products faster, capture deposits and lending margins, and reduce reliance on Banking-as-a-Service partners.

NEWS

🇿🇦 POSB collaborates with Mastercard to launch a new outbound money transfer service. The service aims to provide a fast, secure, and cost-effective way for customers in Zimbabwe to send money directly to bank accounts, mobile wallets, and cash abroad. Additionally, Riyadh Air and Mastercard take off together to redefine the global travel experience through multiple touchpoints. The partners will develop a portfolio of innovative consumer products, including Riyadh Air-branded credit and prepaid cards built for the next generation of travelers.

🇦🇺 ANZ launches agentic AI-powered CRM to transform business banking. The new CRM platform delivers improved customer outcomes and helps bankers work smarter and automate routine tasks. The technology will help boost bankers' capabilities and productivity, allowing more time for bankers to focus on customers.

🇺🇸 Tether announces $100 million strategic equity investment in Anchorage Digital. Both companies are focused on strengthening the core infrastructure required for digital assets to operate safely, at scale, and within clear regulatory frameworks.

🇮🇳 Over 400 Indian banks shift to secure ‘.bank.in’ domain to boost cybersecurity, complying with RBI mandate. This new top-level domain (TLD) is exclusive to verified banking institutions, making it easier for customers to distinguish genuine bank websites from fraudulent or phishing sites that often mimic official portals to steal credentials or carry out financial fraud.

🇻🇳 Cake Digital Bank pioneers bank-led cross-border receivables with Visa. By integrating cross-border receivables within an onshore digital banking framework, it reduces reliance on intermediary layers while improving transparency, settlement efficiency, and oversight of international cash flows.

🇩🇪 Akbank goes live on Mambu core in Germany. Operating under a German banking licence from BaFin, the division serves customers in Germany and the wider EU market, providing banking services and supporting cross‑border financial activity between Europe and Turkey.

🇷🇺 Russia's Sberbank plans crypto-backed loans to corporate clients. Sberbank is moving to offer loans secured by cryptocurrency and says it is ready to work with the central bank on a regulatory framework. Sberbank's planned program will extend crypto-backed lending beyond miners to businesses holding digital assets.

🇳🇴 Moonrise by Lunar launches instant payments in Norway via NICS Real. By connecting directly to NICS Real, Moonrise enables partners to send and receive Norwegian Krone (NOK) in real time, 24/7/365. Continue reading

🇬🇧 Starling founder Anne Boden cuts stake in £4bn FinTech. Anne Boden cut her holdings in the digital bank to near 2.7% from a previous 4.3%. It comes after Starling launched a secondary share sale last year in a bid to enable its current investors to sell down stakes and open up new opportunities.

Want your message in front of 100.000+ Digital Banking fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.