Santander & OpenAI Collaborate on AI-Driven Banking

Hey Digital Banking Fanatic!

Santander is diving deeper into digital transformation by partnering with OpenAI to weave generative AI into daily banking operations, with +15,000 employees already using ChatGPT Enterprise.

Ricardo Martín Manjón, Santander’s Chief Data & AI officer, highlights, “In 2024 alone, AI initiatives have already delivered over €200 million in savings. AI copilots now support more than 40% of contact centre interactions.”

There’s more to the Santander and OpenAI partnership, and a lot is unfolding in digital banking right now. Keep reading to stay in the loop 👇

See you tomorrow!

Cheers,

INSIGHTS

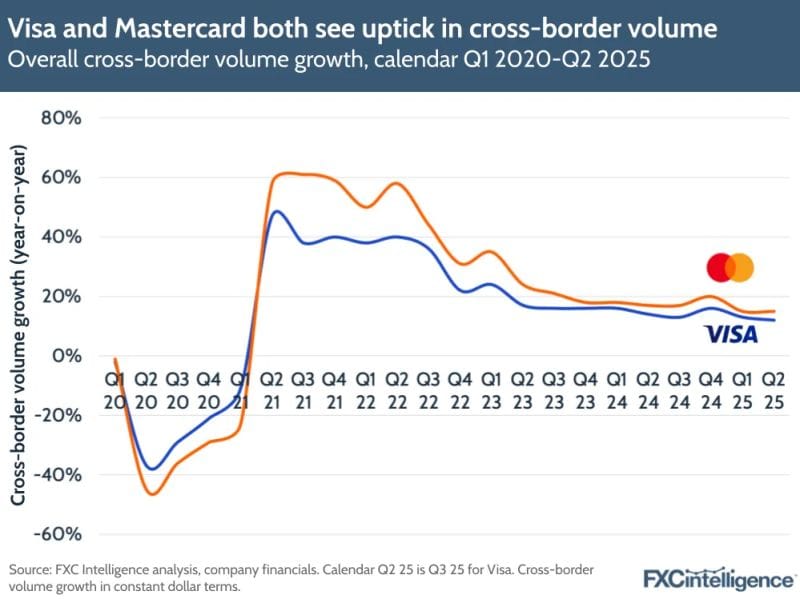

📈 Visa and Mastercard both see an uptick in cross-border volume.

Overall cross-border volume growth, calendar Q1 2020–Q2 2025 👇

NEWS

🇳🇱 Airwallex receives MiFID licence to launch Yield in the Netherlands, paving the way for European businesses to generate income on idle funds. This important authorisation will enable Airwallex to offer Money Market Funds, a new way to generate returns on their idle cash - an opportunity that is not typically available through traditional banks.

🇬🇧 BVNK introduces Smart Treasury. This new feature is available for customers of Layer1, BVNK’s self-managed infrastructure solution. It also powers BVNK’s treasury operations, bringing efficiency benefits for customers using our managed payments service.

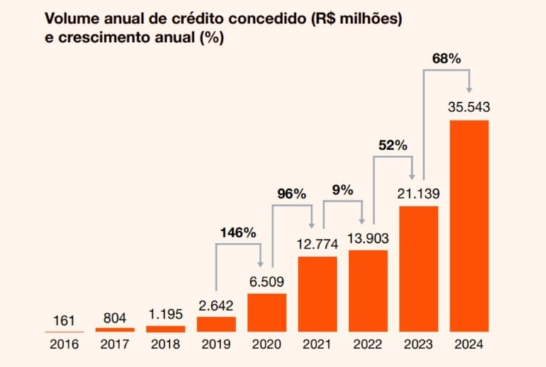

🇧🇷 Credit FinTechs lend R$35.5 billion in 2024; defaults among individuals rise. Despite high interest rates and an uncertain macroeconomic scenario, credit FinTechs in Brazil increased their loan volume in 2024 compared to the previous year. Default rates increased in loans to individuals, but declined in loans to legal entities.

🇪🇸 Santander charts "data and AI-first" future with new OpenAI partnership. The Spanish banking group, which has previously deployed AI for fraud detection and customer service enhancement, is now expanding its generative and agentic AI capabilities across product management, credit, marketing, service, operations, and other banking functions.

🇬🇧 Tide tackles fraud with a simple change to payment cards. Tide is aiming to tackle payment fraud by modifying the cards it issues to customers. The LocalGlobe-backed firm has decided to remove printed numbers from its payment cards, in a move it describes as a first for business card providers.

🇬🇧 Revolut still doesn’t have its full UK banking licence. Last July, Revolut finally obtained its long-awaited UK banking licence. But one year later, Revolut’s banking licence remains in the “mobilisation” period, awaiting a final sign-off before it can start operating as a fully licensed bank in its home market. Additionally, Revolut seeks regulatory approval from Morocco’s Central Bank. While awaiting a response from the Moroccan central bank, the FinTech giant, which claims a global user base of 60 million, will continue its recruitment drive to support operations.

🇰🇭 Cambodian digital bank launches nation’s first debit-credit card. Wing Bank, a digital bank in Cambodia, has launched the Mastercard One Card, the first in the country to combine debit and credit card functions in a simple card. Keep reading

🇲🇽 Mexico FinTech Stori eyes IPO by 2027 with trend toward profits. The company offers payment cards, personal loans, and high-interest deposit accounts in the country with a focus on the underbanked population. Stori claims to have a 99% approval rate for its credit card as part of its strategy of targeting middle- and low-income consumers.

🇦🇺 ubank & Infinity Squared bring clarity to financial chaos in new campaign. See Money Better, Do Money Better brings to life the invisible stresses of modern money management. The campaign reimagines the overwhelming money moments that are all too familiar for young Aussie banking customers.

🇬🇧 Clearbank enters channel relationship with Algbra. Through the partnership, Algbra will be able to offer ClearBank’s agency banking, faster payments, and virtual account services to customers on its platform, helping them expand their reach without having to reinvent backend infrastructure.

🇧🇷 Nubank appoints Eric Young as Chief Technology Officer. Young will report directly to David Vélez, founder and CEO of Nubank, focusing on maintaining operational excellence, driving international expansion through platformization, and advancing critical AI technologies to accelerate growth.

Want your message in front of 100.000+ Digital Banking fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.