Santander Partners with Worldpay on SMB Support

Hey Digital Banking Fanatic!

A 150-year-old bank and a millennial-era payment processor have teamed up to expand Santander’s offering and sharpen its capabilities in the UK business landscape.

Santander UK and Worldpay have announced a long-term agreement aimed at changing how business customers manage payments, both in-store and online.

The partnership will give Santander’s Business Banking and Corporate and Commercial Banking clients access to Worldpay’s infrastructure: PoS systems, e-commerce tools, and tailored implementation support. It’s a direct route to essential services that might otherwise involve multiple providers, added fees, or complex integration.

Gerry Davies, Payments Commercial Director at Santander UK, framed the move around customer value: “Our new partnership with Worldpay will give our UK customers access to secure and innovative ways to accept payments, alongside a suite of value-added services to help improve efficiency and grow their business.”

Chris Wood, General Manager for SMB UK and Ireland at Worldpay, highlighted the strategic alignment: “This long-term agreement opens an important new distribution channel with one of the UK’s most preeminent banks to support more businesses with the tools they need to drive growth.”

In a market where speed, flexibility, and digital fluency matter more than ever, even legacy institutions are adapting. Business customers, large and small, are looking for more integrated, tech-forward solutions to support growth in an increasingly borderless economy.

Read all the other Digital Banking industry news below 👇 and I'll be back with more tomorrow!

Cheers,

Explore Latin America’s FinTech growth. Join my weekly newsletter to stay informed—don’t miss a beat!

INSIGHTS

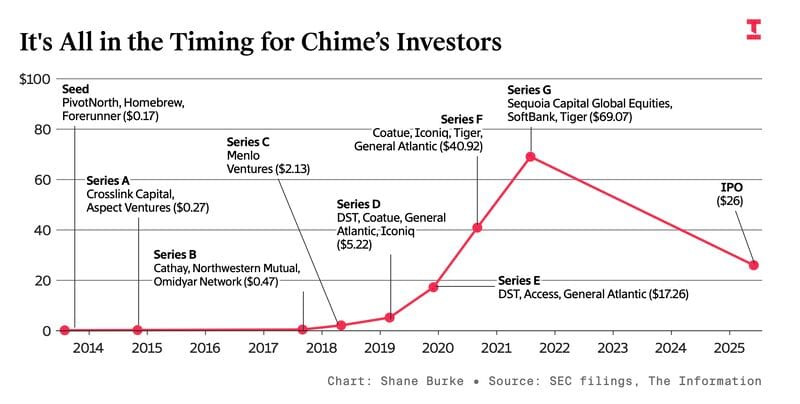

📈 Chime’s IPO Will Have Big, Big Winners and Serious Losers.

NEWS

🇬🇧 Santander partners with Worldpay to support business banking and corporate customers. The partnership will offer Santander customers secure, scalable, and efficient merchant payment solutions. For business customers, a wide range of solutions will be available for all point-of-sale, e-commerce, and integrated payment needs.

🇲🇾 KAF Digital Bank goes live on Temenos SaaS to elevate Islamic digital banking in Malaysia. With Temenos SaaS, the bank is set to deliver innovative Shariah-compliant financial solutions that simplify financial management and enhance digital convenience with a cutting-edge, user-centric banking experience.

🇬🇧 UK finance watchdog teams up with Nvidia to let banks experiment with AI. The Financial Conduct Authority said it will launch a so-called Supercharged Sandbox that will “give firms access to better data, technical expertise and regulatory support to speed up innovation.”

🇱🇺 Luxembourg left out of Revolut’s new payment rollout. The rollout will enable customers to send and receive money instantly via the Wero digital wallet. Wero will support mobile numbers from France, Germany, and Belgium, but the platform aims to expand its reach.

🇳🇬 First Ally Capital acquires majority stake in Mines.io Nigeria, operating under the brand name Migo, a FinTech company. The acquisition aligns with First Ally’s strategic objective to drive the application of technology in the delivery of financial services to a larger proportion of the population.

🇳🇿 Westpac partners with Akahu to boost open banking access. With this new connection, open banking will quickly come to life for Westpac customers who will be able to seamlessly and securely link their accounts to an established ecosystem of innovative financial tools and services.

Want your message in front of 100.000+ Digital Banking fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.