Stablecoin Neobank Kontigo Hit By $340K Hack And Promises Full Reimbursement

Hey Digital Banking Fanatic!

Kontigo, a stablecoin-focused neobank serving Latin America, was hit by a security breach that drained more than $340,000 in USDC from customer wallets.

Unauthorized access was detected, systems were isolated, and an investigation is now underway with external cybersecurity specialists. The incident affected just over 1,000 users.

Services are being gradually restored under reinforced monitoring as the company works through the fallout and reviews what went wrong.

Kontigo moved fast to set the record straight. All impacted users will be reimbursed 100 percent, handled case by case under its security protocols.

The episode lands at a tense moment for the sector, with crypto wallets and platforms facing a fresh wave of attacks and renewed scrutiny around security and trust.

If you’re following how Digital Banking and crypto-native finance are being tested, keep scrolling 👇 Tomorrow I'll be back with the next round of updates!

Cheers,

INSIGHTS

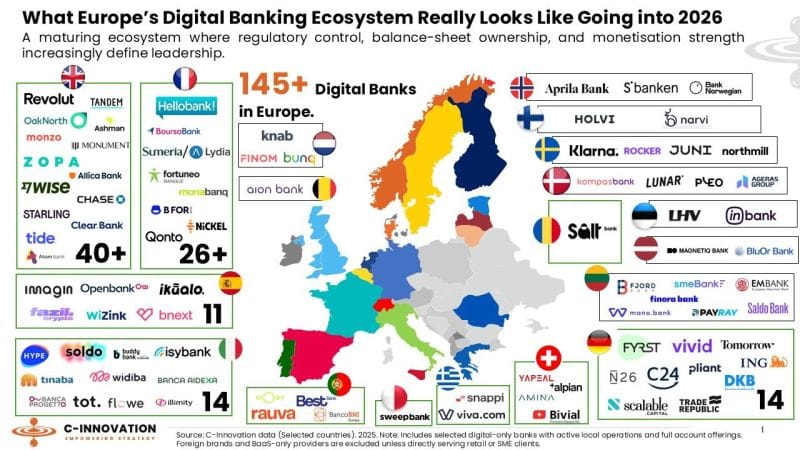

🌍 Europe's Digital Banking Ecosystem going into 2026👇

Which neobank is missing in this overview?

NEWS

🇦🇺 Airwallex names James Teodorini as new ANZ head & records volume. The FinTech said Teodorini will oversee its regional strategy and commercial activities in the two markets. The business has reported annualised transaction volume of more than USD $235 billion, an increase of 127% year on year.

🇺🇸 Stablecoin neobank Kontigo hit by $340K USDC hack, vows 100% reimbursement. The company stated that it will fully reimburse affected users on a case-by-case basis, following user reports of unauthorized access attempts and coming shortly after Kontigo closed a $20 million seed funding round.

🇩🇪 Solaris names Steffen Jentsch to lead embedded finance platform. “Jentsch brings a proven track record in scaling digital financial platforms, along with deep expertise in regulatory transformation and digital banking solutions,” the announcement said.

🇧🇷 Brazilian FinTech PicPay discloses revenue jump in US IPO paperwork. The move comes as the IPO market shows signs of recovery following years of weakness, with analysts expecting further momentum in 2026 despite recent market volatility.

🇦🇪 Yuze and Zand partner to deliver AI-driven digital business banking for UAE SMEs. The partnership aims to make financial services easily accessible to eligible businesses through fast onboarding, an IBAN account, digital banking products, and advanced business tools through Yuze’s platform to manage and grow their businesses.

🇸🇬 Tonik appoints former TNEX CEO, Bryan Carroll, to a Senior Role. Carroll joins Tonik with extensive experience in the digital banking sector, having previously served as the CEO and Co-Founder of TNEX, Vietnam’s digital-only bank.

🇳🇬 Sterling Bank joins Thunes' direct global network to transform cross-border payments for Nigerian expatriates. By leveraging Thunes' Direct Global Network, Sterling Bank is rolling out this enhanced capability across multiple European markets, giving customers abroad a more consistent way to support their families and manage finances.

🇺🇸 Morgan Stanley files for Bitcoin and Solana ETFs in a digital assets push. The move will deepen the bank's presence in the cryptocurrency space and comes two years after the SEC approved the first U.S.-listed spot bitcoin ETF. Continue reading

🇧🇷 Avenue has received a license from the Central Bank of Brazil (BC) to operate as an investment bank. This authorization represents a significant regulatory milestone and reinforces the company's long-term strategic positioning within the financial system.

🇮🇳 Fino Payments Bank implements a new core banking system, Finacle. The new core banking system will serve as the Bank's digital backbone, enabling enhanced operational efficiency, greater system resilience, and improved scalability.

🌍 IMF urges stronger cyber risk rules as digital finance expands across Africa. The IMF warns that cyber threats to the financial sector are becoming more frequent, sophisticated, and damaging, posing growing risks to financial stability, consumer trust, and economic activity.

🇮🇳 Axis Bank launches ‘Safety Centre’ on its mobile banking app to give customers control over key features. The Safety Centre enables customers to tailor security settings based on their usage and comfort, the private sector bank said in a statement.

🇨🇭 radicant bank appoints Matthias Kottmann as Chairman. In his new role, Kottmann will oversee the orderly wind-down of the bank’s activities, which is expected to be completed by April 2026. A key priority under his leadership will be the execution of a recently signed agreement with Alpian, a Swiss digital bank.

🇵🇰 Veon pumps $20m in Mobilink Microfinance Bank. Veon said the funding will support growing demand for digital and Islamic banking services, as well as broader development of Pakistan’s digital economy. Keep reading

🌍 Citi and CredAble launch a platform to digitize trade finance. This platform aims to streamline business operations and bring efficiency through technological advancements in trade finance. By implementing a digital approach, Citi seeks to enhance operational transparency and efficiency for its corporate clients.

Want your message in front of 100.000+ Digital Banking fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.