Standard Chartered HK Launches Zero-Fee SC Invest

Hey Digital Banking Fanatic!

Standard Chartered Hong Kong has rolled out SC Invest. The fund investment platform features zero fees with a starting point of just HKD 100.

This platform offers four globally diversified portfolios, each holding 20+ ETFs and funds, targeting emerging affluent clients who want to start small and grow big.

Digital wealth revenue at SC HK jumped 1.2x YoY in H1 2025, and this move is aimed at capturing the untapped “emerging affluent” market.

Zero fees, other big moves, and more below 👇

See you Monday!

Cheers,

INSIGHTS

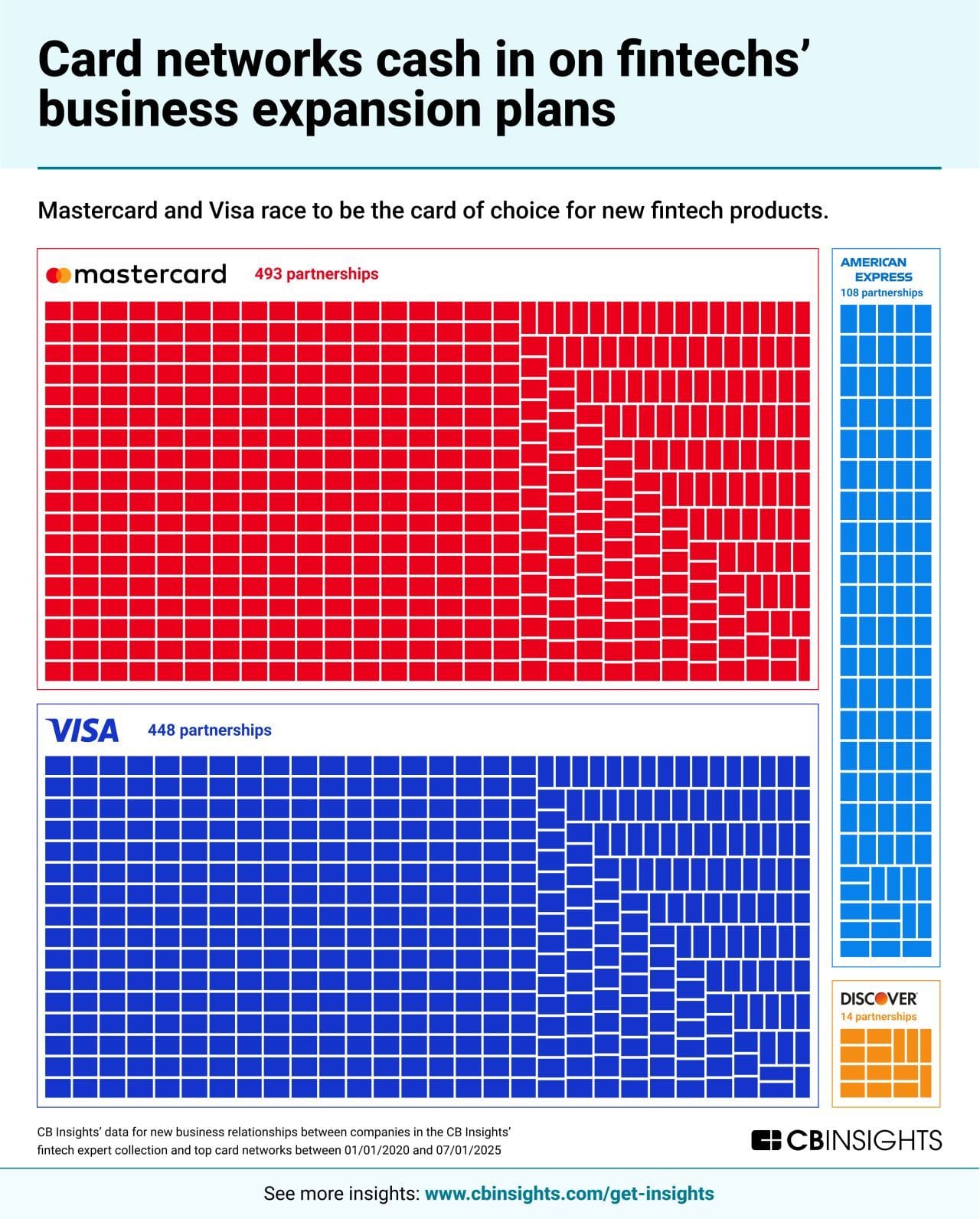

📊 Mastercard and Visa race to be the card of choice for new FinTech products.

NEWS

🇨🇳 Standard Chartered Hong Kong launches SC Invest platform. The platform simplifies the fund investment process, offering four foundational portfolios curated by the Bank’s Chief Investment Office. It features low investment entry thresholds and zero fees.

🇮🇳 PSU banks to hold majority in digital payment intel body. DPIP aims to enhance fraud risk management through real-time intelligence sharing and prevent fraudulent transactions. A committee comprising public and private banks, MeitY, and the RBI will finalize the structure, ensuring representation from FinTech companies and payment banks.

🇲🇾 Malaysia's Ryt Bank selects Episode Six to power card services ahead of launch. Episode Six's card issuing and ledger infrastructure will provide Ryt Bank with instant card issuance capabilities, as well as personalised spending controls and real-time authorisations.

🇵🇭 Philippine central bank orders e-wallets to drop gambling links. Financial firms have 48 hours to take down icons redirecting to Internet betting, according to Bangko Sentral ng Pilipinas Deputy Governor. Senators are tackling proposals to either restrict or ban online gambling amid concerns over debt and addiction.

🇰🇷 Toss posts 35% revenue growth in the first half of 2025. "Increased service usage from our strong 30 million user base, along with improved profitability in our core business segments, has driven overall performance growth," the FinTech firm stated.

🇮🇳 PhonePe tops UPI in July with 8.93 bn transactions and 46% market share. PhonePe’s total value processed stood at ₹12.20 trillion, followed by Google Pay’s ₹8.91 trillion and Paytm’s ₹1.43 trillion. Its market share by volume was 45.88% in July, while its closest competitor, Google Pay, cornered 35.56%.

🇨🇳 AMINA Bank taps banking leader Michael Benz to lead APAC expansion. Franz Bergmueller, CEO of AMINA Bank, stated that Michael's expertise in both traditional finance and crypto positions him as the ideal leader to drive the bank's continued expansion across Asia.

🇪🇬 HSBC Egypt launches Treasury APIs for real-time access to award-winning cash management services. The service allows corporate clients to integrate directly with the bank’s treasury and payment systems, providing real-time access to HSBC’s full suite of cash management solutions.

Want your message in front of 100.000+ Digital Banking fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.