Starling’s IPO Question Just Got Louder

Hey Digital Banking Fanatic!

Starling Bank’s IPO story just took a sharp turn...

Its largest backer, billionaire investor Harald McPike, has pulled his support for a London listing, citing frustration with the pace of UK market reforms.

McPike put $70 million into Starling back in 2016 and still owns roughly a third of the bank. Now, according to people familiar with his thinking, patience with the City is wearing thin, and the door to New York looks increasingly open.

That matters. Starling’s leadership has shifted its tone over the past year, moving from “London is our natural home” to a much more non-committal stance on where an eventual IPO might land.

Another data point in a growing pattern. UK FinTech champions are weighing global capital markets. London is still in the conversation. But no longer the default.

If you’re tracking how Digital Banking keeps evolving across markets, keep scrolling 👇 I’ll be back shortly with more first-hand stories shaping the sector.

Cheers,

INSIGHTS

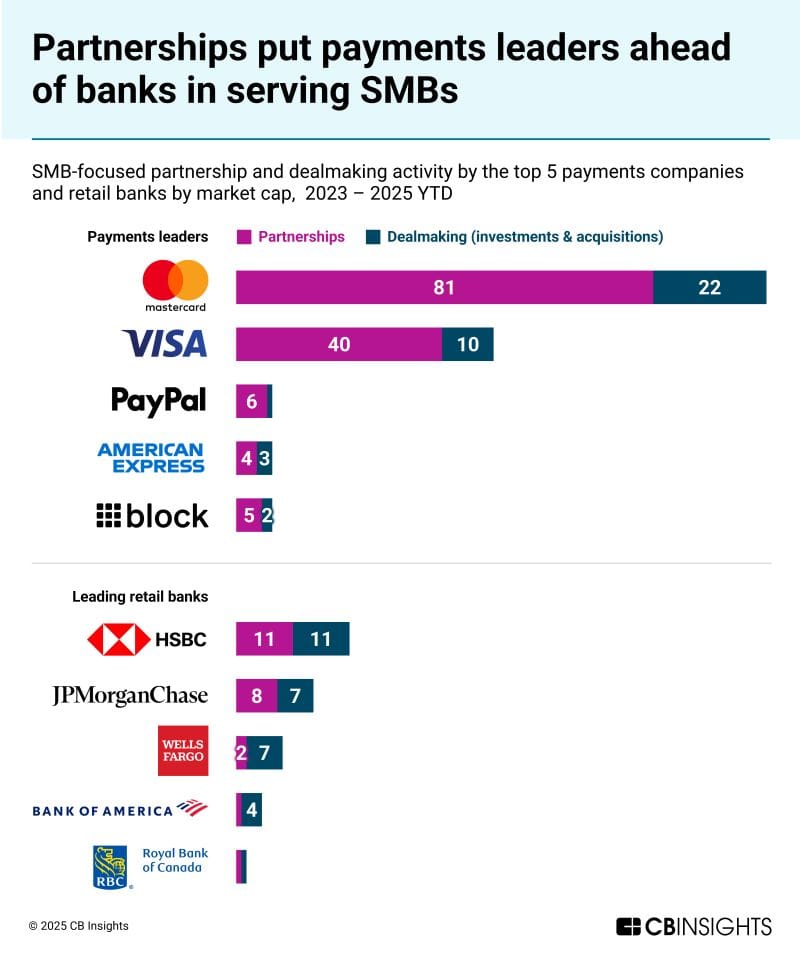

📊 SMB-focused partnership and dealmaking activity by the top 5 payments companies and retail banks by market cap, 2023–2025 YTD 👇

NEWS

🇬🇧 Starling supercharges savings offering with new Cash ISA and revamped easy saver. This move allows users to effortlessly segment their tax-efficient savings for different life goals, a key differentiator in the crowded market. Starling’s top investor withdraws support for London IPO. Harald McPike, who invested $70m in Starling in 2016 and still holds around a third of the bank, is said to believe the company is increasingly open to a US listing despite his earlier opposition.

🇬🇧 Revolut ramps up legal hiring amid expansion drive. Revolut is planning to grow its legal team by 15% in a bid to keep up with rapid expansion at the digital bank. The London-based FinTech is hiring for 29 legal roles globally, including in the UK, Europe, the Middle East, North America, and Asia, according to job postings.

🇦🇺 Revolut unveils unified payments platform for Australia. The company said Australian businesses can accept payments, settle funds, and manage payment operations through a single platform alongside their business account. Additionally, Revolut Business enters Singapore’s merchant payments market, allowing businesses to accept online and in-person payments from a single platform. The launch brings merchant acquiring into the Revolut Business account, combining account-to-account, online, and in-store payments.

🇬🇧 UK Crypto Neobank Plutus raises $2.3m on base with PlusMore. This move reinforces Plutus’ commitment to security, governance, and community-driven adoption, while ensuring that PlusMore users holding PLUS can enjoy both immediate and long-term benefits through its RaaS ecosystem.

🇬🇧 Chase enters the UK insurance market. The new product is a bundle of worldwide travel insurance, mobile phone insurance, and AA UK breakdown cover, available for a fixed monthly rate of £12.50. Customers can purchase and manage their cover and submit any claims via the Chase app.

🇲🇾 Aeon Bank CEO Raja Teh Maimunah to step down on March 31. Raja Teh joined the bank three years ago and steered Aeon Bank through its inception as a digital bank. She said her tenure at the bank was a "profound honour and a once-in-a-lifetime privilege."

🇮🇹 Hype launches SplitHype. The new feature is designed to simplify group expense management and reduce friction, billing, and arguments among friends, families, or roommates. It is integrated directly into the app and is available to all Hype customers, regardless of their plan.

🇱🇹 SME Bank selects Flagright for real‑time transaction monitoring and watchlist screening. The partnership aims to strengthen SME Bank’s financial crime controls while maintaining fast, scalable operations. SME Bank provides digital banking and lending services to small and medium-sized enterprises as it expands across the region.

🇨🇴 Columbia Bank inks $597m merger with Northfield Bank. As part of the move, Columbia will undertake a second-step conversion to transition from its mutual holding company structure to a fully public stock holding company. This process involves the creation of a new holding company to serve as the parent of the combined banks.

🇨🇴 Yape enables direct transfers from Peru to Nequi in Colombia to expand its regional reach. This new feature allows users to send funds between the two platforms with crediting in a matter of minutes, simplifying a common process for thousands of users who send money abroad.

🇺🇸 Santander agrees to buy US bank Webster in $12.2bn deal as UK weighs on profits. Banco Santander Executive Chair, Ana Botín, said the deal was 'strategically significant' for Santander's US business and offers 'meaningful, tangible value' for the group.

🇺🇸 U.S. Bank adds industry veterans to its payments. Peter Geronimo has joined U.S. Bank to lead the company’s new PMI Sales Distribution team, and Raj Gazula has joined to lead strategy and serve as the Chief Administrative Officer for PMI. This new team will further enable U.S. Bank to deliver a holistic approach to clients.

🇮🇱 Remitly cuts 110 jobs in Israel and closes R&D hub three years after $80 million Rewire acquisition. The company will retain only sales and business roles in the country, marking a sharp retreat from the engineering footprint it inherited through the acquisition.

🇺🇸 United Financial Credit Union partners with Nuuvia to launch SmartStart Youth Banking Platform. Nuuvia's youth banking platform integrates seamlessly within United Financial Credit Union's existing digital banking infrastructure, providing a secure, modern mobile-first experience for children, teens, and their parents.

🇨🇱 Global66 reports historic growth in 2025. During 2025, the platform facilitated the transfer of US$3.7 billion from Chile abroad, representing an explosive growth of 157% compared to the previous year. Continue reading

Want your message in front of 100.000+ Digital Banking fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.