Step Expands Beyond Banking With AT&T Mobile Plans

Hey Digital Banking Fanatic!

The expansion of digital banking into telecom is gaining traction. What began in Europe with Revolut and N26 has now reached the U.S., as Step becomes the latest neobank to enter the mobile space, with thousands already on the waitlist.

Step Mobile is now live, the service is exclusive to Step customers and operates on AT&T’s network. There are two options: a 5GB plan at $15 and an Ultra Unlimited 5G plan for $35. Step says customers could save up to $600 annually, while also building credit through monthly payments.

More than just a cost-saving tool, Step Mobile adds a new layer to the company’s growing ecosystem. Alongside banking and credit-building features, mobile service becomes another point of connection between young people and financial management.

"We’re equipping the next generation not just to survive adulthood—but to take control and own it, with safe and powerful tools that put them in charge of their financial future, build credit, and provide them the financial flexibility needed in today’s world," said CJ MacDonald, CEO & Founder of Step.

Unrelated, but worth noting: two months ago, U.S. digital bank Openbank partnered with telecom provider Verizon, not to launch mobile plans like Step, but the other way around. The collaboration gave Verizon customers access to a high-yield savings account via Openbank. A different approach, but it highlights a growing pattern: telecom and banking services appear to be moving closer together.

Read all the other Digital Banking industry news below 👇 and I'll be back with more tomorrow!

Cheers,

INSIGHTS

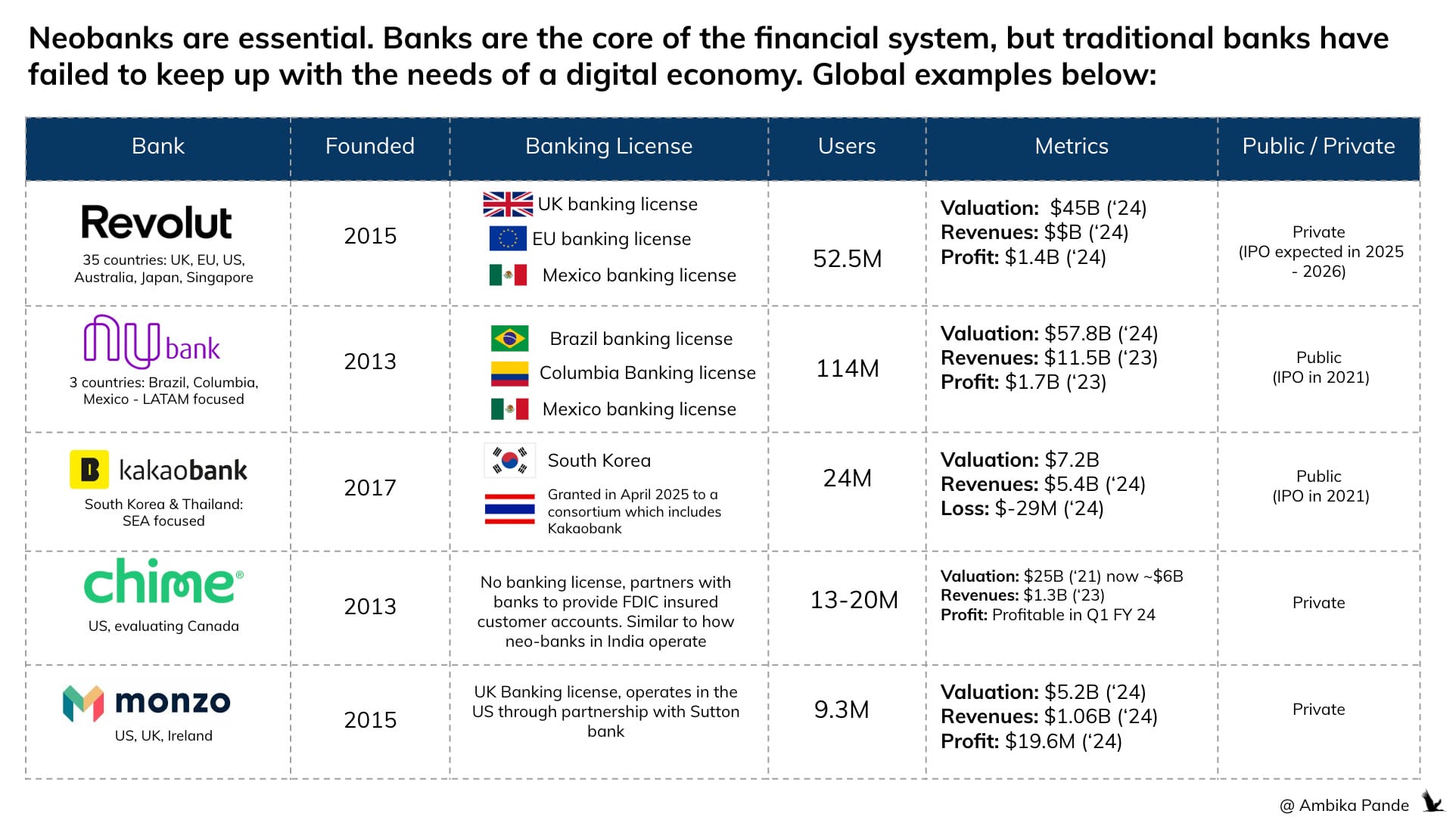

💰 Neobanks are essential. Banks are the core of the financial system, but traditional banks have failed to keep up with the needs of a digital economy.

Check out these Global examples👇

DIGITAL BANKING NEWS

🇺🇸 Step launches modern mobile plans to empower Gen Z’s independence and financial growth starting at $15 a month. Step Mobile customers will enjoy a premium experience and the fastest speeds available, providing a network equipped for Gen Z data usage on a budget they can afford.

🇬🇷 Revolut opens a branch in Greece and will offer a Greek IBAN. Greek IBAN will allow it to provide more services, such as payroll accounts and broader credit provision. This move comes as a result of the high penetration that Revolut already has in the Greek market. Meanwhile, Revolut adds travel cover for Premium and Metal users. The service will be available to new and existing Premium and Metal customers. They will gain access to travel insurance benefits.

🇵🇹 Wizink will start receiving deposits in Portugal. The digital bank will start accepting deposits in 2026 and will launch Aplazame, the Buy Now Pay Later technological tool, later this year. Read more

🇺🇸 Chime’s approach to Payday lending is costly. This aims to provide users with early access to their earned wages without the high costs associated with traditional payday loans. Continue reading

🇺🇸 Chime IPO tests market appetite for FinTech investment. This would be a significant breakthrough given the drop in FinTech venture capital exit value from IPOs from $222.4 billion in 2021 to just $29.1 billion over the following three years, up to Q1 2025.

🇺🇸 PayPal Crypto Head says banks are needed to unlock full stablecoin potential. Jose Fernandez da Ponte, PayPal’s Senior Vice President of Digital Currencies, remarks came amid efforts to bring regulatory clarity for digital assets in the U.S., with lawmakers inching closer to passing stablecoin legislation that could redefine the market and allow banks to enter the space.

🇬🇧 TransferGo teams up with Griffin for GBP wallets and savings as it launches multi-currency business accounts. This partnership allows TransferGo to leverage Griffin’s safeguarding infrastructure for its GBP wallets and offer savings accounts with competitive interest rates to UK businesses.

🇬🇧 Lloyds Banking Group selects Moneyhub as data enrichment partner. This will support customers to understand what they spend their money on and improve their personalized digital banking experiences. Moneyhub’s technology will categorise all of the bank’s transactions for both income and expenditure.

🇮🇸 Iceland's Arion Bank upgrades payments infrastructure with Volante. Through the partnership, Volante will integrate its Payments-as-a-Service solution into Arion's tech stack. The cloud-based solution supports end-to-end processing across a range of payment types.

Want your message in front of 100.000+ Digital Banking fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.