SumUp Goes Full Bank Mode: EU & UK Licence Applications Coming

Hey Digital Banking Fanatic!

SumUp, the FinTech best known for powering your favorite coffee shop’s card reader, is going bigger. Much bigger.

The company confirmed plans to apply for a full EU banking licence next year, with the UK to follow.

That means SumUp isn’t just chasing card payments anymore—it’s eyeing the big leagues: SME lending and full-service business banking.

With 4 million merchants already on its platform and fresh profits on the books, SumUp thinks it can outmaneuver traditional lenders by turning its rich payments data into smarter credit and banking products.

Or in other words: less red tape, more actual help for small businesses.

Spain, Italy, Poland… you’re on SumUp’s radar. And with a potential IPO also in prep, this is one to watch closely.

More digital banking stories you need to know are just below 👇 And I'll be back for more tomorrow!

Cheers,

INSIGHTS

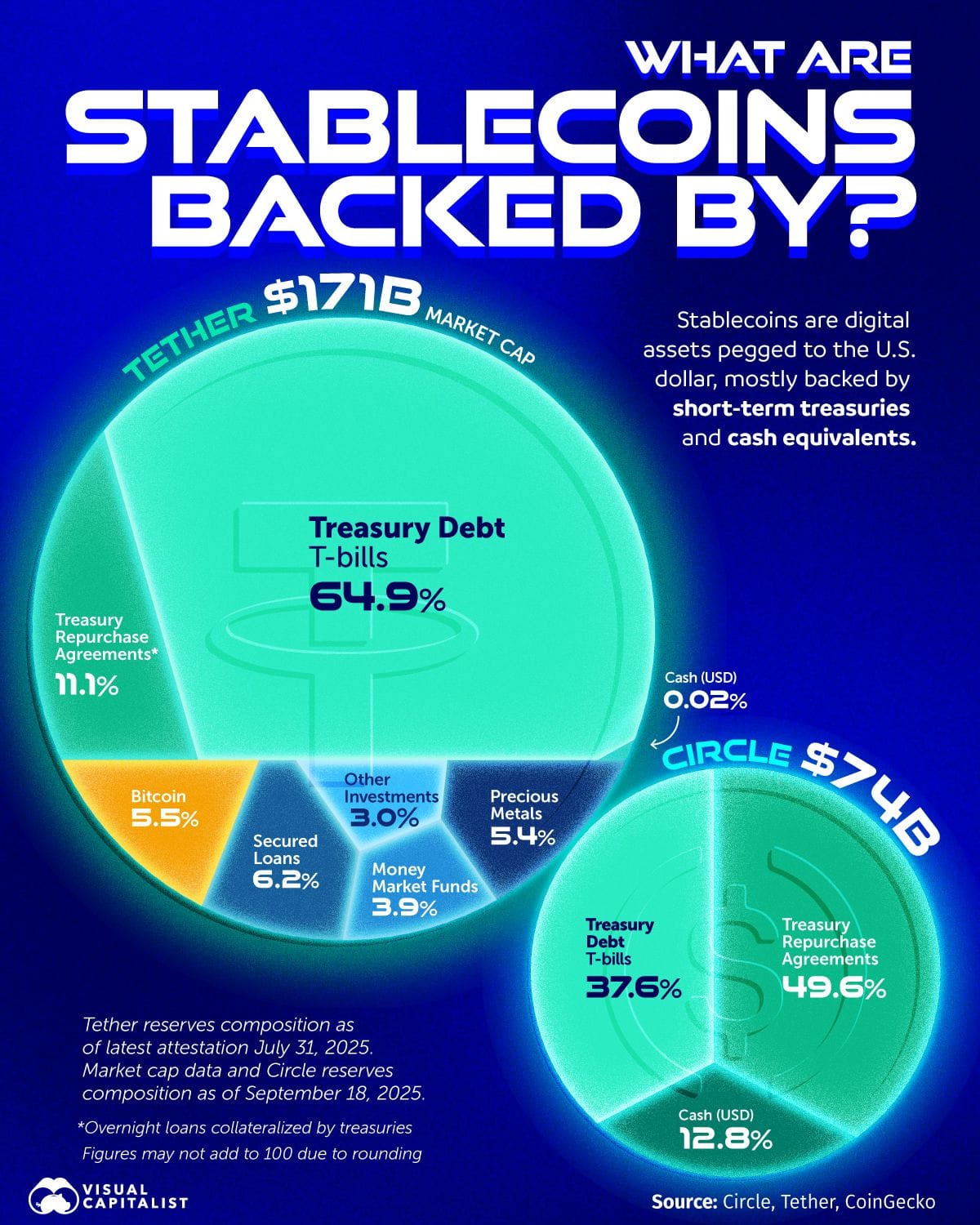

🇺🇸 What backs stablecoins like Tether and Circle? A breakdown of their reserves shows U.S. treasuries dominate their holdings👇

NEWS

🇪🇺 FinTech SumUp targets EU and UK banking licences. SumUp is preparing to enter the banking space, with plans to apply for an EU banking licence as early as next year, followed by a UK application. The move comes as the company looks to scale its offering and compete more directly with incumbent lenders.

🇫🇷 French neobank Shine expands to Europe, six months after its surprise sale by Société Générale. The name of the French neobank will serve to unify all of its new parent company's companies and products in Europe. The goal: to become a "one-stop shop" for the professional market.

🇬🇧 How Revolut’s UK bank became CEO Nik Storonsky’s ‘number one priority’. Regulators in the US, Australia, New Zealand, and Switzerland have told Revolut executives that they would like to see the FinTech certified by its domestic watchdog as they work to sign off on other licenses.

🇱🇺 Revolut surpasses 100,000 Luxembourg customers. The bank stated that it was the most downloaded finance application in the Grand Duchy in the third quarter of 2025, which it said positioned the company among the top tier of financial players in the market.

🇸🇦 QNB Group receives Saudi Central Bank license approval for new digital bank, ezbank. With ezbank, the goal is to introduce a new model of customer-centric banking built around innovation, efficiency, and accessibility. The entity aims to offer a digital-first banking experience that is simple, inclusive, and secure, and to provide innovative solutions for the youth and entrepreneurs.

🇵🇪 FinTech Ligo will bring Apple Pay and Google Pay to Peru. More than 186 million monthly transactions were made under this system, which integrates instant transfers, mobile payments, and QR code operations. The company is seeking to consolidate its financial ecosystem and diversify its business lines to integrate two international giants.

🇺🇸 Coinbase’s Bitcoin-Backed loans surpass $1B as exchange prepares to lift borrowing cap. The move comes as the asset-based lending industry continues to expand. A July report projected the market could reach $1.3 trillion by 2030, reflecting broader interest in loans secured by assets beyond traditional real estate or vehicles.

🇺🇸 Stripe plans to apply for a federal charter in a stablecoin push. Stripe is expanding into digital assets with a new stablecoin issuance platform and plans to seek U.S. banking licenses, moves that bring the payments giant closer to traditional financial regulation. The new service is called Open Issuance.

🇩🇪 Nium launches Global Collections to power cross-border collections for banks. Nium's Global Collections is a white-label solution that enables banks to offer multi-currency collection accounts directly to their customers, powered by Nium's virtual account infrastructure and APIs.

Want your message in front of 100.000+ Digital Banking fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.