Superbank’s $1.3M Profit Adds IPO Momentum

Hey Digital Banking Fanatic!

Just over a year after launching its app, Superbank has reported a net profit of $1.3 million and built a user base approaching 4 million. 🤯

The Indonesian digital bank is gaining ground fast. In the first half of 2025 alone, it disbursed $525 million in loans, while total assets climbed close to $1 billion.

In January, Superbank was reportedly planning an IPO this year, aiming for a valuation of up to $2 billion. With six months to go, could it become Jakarta’s next major listing?

Keep scrolling to learn more about Superbank's update and the latest moves across the digital banking industry 👇

See you on Monday!

Cheers,

Stay Updated on the Go! Join my new Telegram channel for daily Digital Banking updates and real-time breaking news. Stay informed and explore the Future of Banking—subscribe now!

INSIGHTS

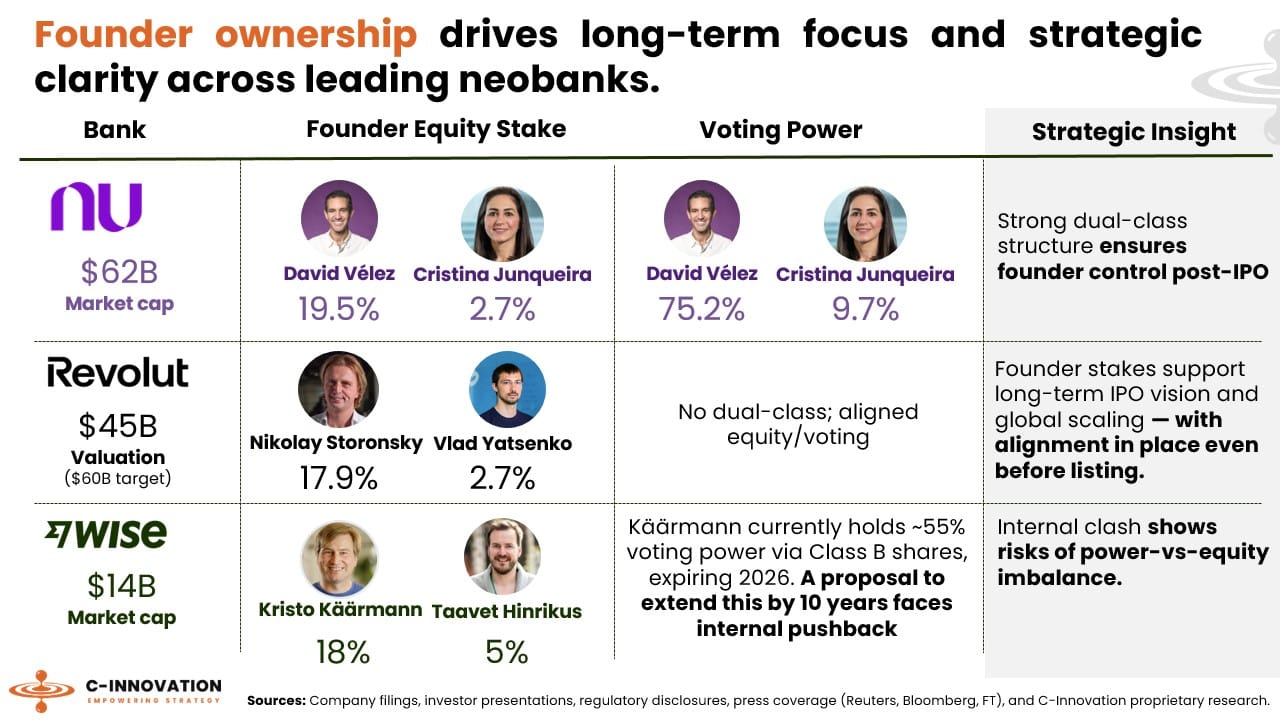

📈 Founder ownership and voting power: Nubank 🆚 Revolut 🆚 Wise

NEWS

🇮🇩 Superbank hits $1.3M in profit and gains 4 million users. Indonesia's Superbank reported a net profit of 20.1 billion rupiah (US$1.3 million) and nearly 4 million customers in the year since it launched its digital banking application in June 2024.

🇬🇧 Leaked documents reveal Revolut's plans for 2026 product blitz. Europe’s most valuable FinTech plans to offer more lending services in Britain next year, according to sources, with a blitz of previously unreported products set to launch in different countries around the world.

🇮🇹 Revolut revolutionizes connectivity: eSIM and global data plans for Italian travelers. This innovation allows users to stay connected anywhere in the world, eliminating the dreaded roaming costs and ensuring a stable and affordable connection in over 100 countries.

🇨🇳 Mox launches digital bank's insurance arm. Mox Insure, with its first product being a personal accident insurance plan called Personal Accident Cushion. The policy covers both local and overseas protection, offering up to HK$2 million in compensation for accidental death or permanent disability.

🇺🇸 Lili launches BusinessBuild Program to empower small businesses to build their credit profile. The BusinessBuild Program is designed to change awareness and improve understanding by embedding smart credit-building tools into everyday financial operations.

🇬🇧 Starling revaluation jump-starts shares in Chrysalis. They said: The material increase in the valuation of Starling was a function of both the progress made in the core UK bank, but also the inclusion for the first time of a valuation for Engine, its banking-as-a-service technology platform.

🇪🇸 Bitstamp, by Robinhood, partners with BBVA to provide Bitcoin and Ethereum trading for retail customers. Bitstamp is serving as one of the first liquidity providers for BBVA’s new offering, now available to all eligible retail customers in Spain. This enables clients to buy, sell, and hold cryptocurrencies directly through the BBVA app.

🇩🇪 Bling acquires financial education app Finstep. By integrating Finstep's proven learning content, Bling strengthens its position as the leading platform for financial literacy in families. The integration creates a unique ecosystem of financial education, pocket money management, and family organization, bundled in one app that supports families in their everyday lives.

🇬🇧 ClearBank appoints David Samper as group CFO. Samper will lead the organisation through its European expansion, as well as its next phase of international growth. Continue reading

🇬🇧 NatWest to deliver buy-to-let mortgages on Landbay. The agreement will see NatWest Group enter the growing Limited Company buy-to-let mortgage market, leveraging Landbay’s award-winning lending platform and extensive broker distribution network.

🇸🇬 Ant International’s Antom and KASIKORNBANK announced the launch of K PLUS, a new local payment method on Google Play, marking the first time that a SEA mobile banking app is made available as a payment option in the platform. Android devices will be able to pay for global and local digital content on Google Play using their everyday banking app.

🇬🇧 Atom Bank expands Technology Leadership Team with key appointments. Ges Richmond and Orla Codyre have joined as Heads of Lending Delivery, while Kath Langlands has been appointed as Head of Platform and Enterprise Delivery. Rob Smith as Head of Engineering, with Rob Butcher named Head of Architecture. Faizah Rafique has been appointed Head of Business Analysis, and James Kerruish will serve as CISO and Head of Service.

🌍 Openbank Appoints Gonzalo Pradas as Head of Retail. He will be responsible for the retail business strategy in Spain, Portugal, and the Netherlands, as well as the products and digital platform across Europe. Read more

🇺🇸 Klarna prepares for autumn bid to revive $15bn New York float, months after being forced to abort a previous attempt amid tariff-induced market turmoil. The buy-now, pay-later company's Finance Chief has told investors that it is "closely monitoring market conditions and will move swiftly" when the timing is right to launch an IPO.

Want your message in front of 100.000+ Digital Banking fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.