Tuum Steps Into Sharia-Compliant Financial Services

Hey Digital Banking Fanatic!

Tuum, a European-based cloud-native modular core banking platform, is taking a step that may seem unexpected at first: the launch of Islamic Banking and Finance solutions.

But the move is rooted in context. It’s been a year since the company began operating in the UAE—where Sharia compliance isn’t mandatory for all, but essential for serving a wider audience.

This isn’t just a geographic expansion. It’s an entry into a new segment, one where compliance is not just regulatory but deeply tied to ethical standards and community trust. Islamic finance requires more than adaptation; it demands a different foundation.

Tuum’s announcement centers on two core components: Islamic deposits and asset-based lending. These aren’t simply product lines; they embody the principles of Islamic finance, where profit must derive from real economic activity. Central to this is the concept of Mudarabah, a profit-sharing model where returns are generated through legitimate ventures, not interest.

As a newcomer to the segment, Tuum places transparency at the core of its offering. Profit-sharing terms are clearly defined, helping to build confidence between institutions and their clients. On the lending side, each transaction is anchored to a tangible asset, aligning with the prohibition of riba and emphasizing shared responsibility and risk.

Although released as a Minimum Viable Product, this launch signals long-term ambition. The modular framework is designed for scalability, opening the door to an expanded suite of Islamic finance products—from Murabaha to Musharakah. It’s a calculated step toward a system where faith-based principles and digital infrastructure move in sync.

Read all the other Digital Banking industry news below 👇 and I'll be back with more tomorrow!

Cheers,

INSIGHTS

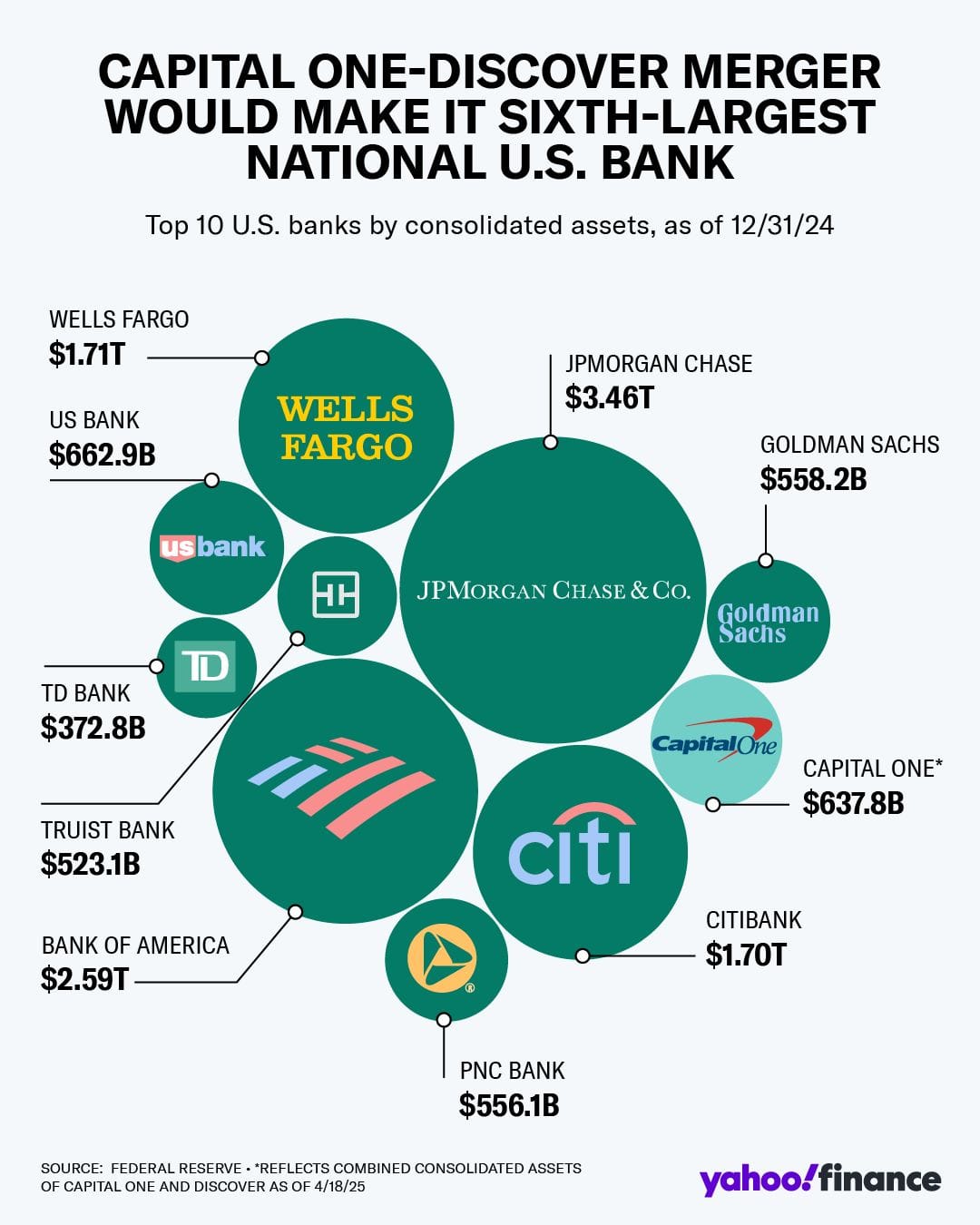

🇺🇸 Capital One’s (COF) $35 billion purchase of Discover (DFS) just got the green light from key regulators, paving the way for the formation of the biggest credit card company and sixth-largest national bank in the US.

DIGITAL BANKING NEWS

🌏 Tuum introduces foundations for Islamic banking and finance solutions to support Sharia-compliant financial services. This initiative is said to focus on the main principles of Islamic banking, laying the groundwork for a platform intended to support the needs as well as requirements of Islamic financial institutions.

🇲🇽 Mexican lender Banorte to scrap unprofitable digital bank. Executives said it would either sell or fuse year-old FinTech Bineo, part of a larger overhaul of the bank's digital strategy to cut costs and simplify operations. If Bineo were fused into Banorte, it would bring its clients and technology with it and could face a name change.

🇦🇺 Australian Open Banking FinTech WeMoney secures $12 million in Series A, backed by Lance East Office and Mastercard. This investment will allow WeMoney not only to maintain leadership in Australia but also to assess prospects on a global stage.

🇵🇹 Rauva has helped create 1,500 companies, 40% of which are based in Lisbon. The program aims to foster entrepreneurship and innovation across Portugal. The platform simplifies the business setup process by providing services such as business account opening, certified invoicing, and access to accounting services.

🇬🇧 Nationwide Building Society extends partnership with Visa to advance account-to-account payments. The new agreement will help drive growth in current account and credit card issuing, to bring the value of Nationwide to a greater number of consumers across the UK.

🇺🇸 Banks expand crypto operations in the US due to easing regulations. A report from the Wall Street Journal cites that recent national adoption in the developing industry is influencing the stance of financial institutions. Continue reading

🇸🇱 Velmie and Metro Cable Africa - Smart Network Carrier launch Vult, Sierra Leone gets first digital banking super app. The app lets users do everything from mobile money transfers and card payments to managing bank accounts. It aims to boost financial inclusion by combining multiple financial services into one easy-to-use platform.

🇬🇧 Revolut gears up for Spring bank holidays and summer travel. Customers will now be able to travel across the globe without additional currency exchange fees, seven days a week. This change comes in anticipation of the summer travel season, with May bank holidays and summer travel on the horizon.

Want your message in front of 100.000+ Digital Banking fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.