US Major Banks Team Up for Joint Stablecoin Initiative

Hey Digital Banking Fanatic!

What once seemed impossible in traditional finance is now becoming hard to ignore. Born in the crypto world, stablecoins are steadily making their way into the mainstream, and now, into the plans of some of the biggest names in banking.

Last Tuesday, SG Forge (the crypto arm of Société Générale) announced it’s preparing a USD-backed stablecoin on Ethereum. The new token, designed for institutional investors, builds on the earlier launch of its euro-pegged version, EURCV. By choosing Ethereum, SG Forge is combining public blockchain technology with regulatory oversight through its EU e-money license.

Just days later, a broader move surfaced. Major U.S. banks, J.P. Morgan, Bank of America, Citi, and Wells Fargo, along with payments platforms like Zelle and The Clearing House, are in early discussions to develop a joint USD stablecoin. While plans are still taking shape, the fact that these institutions are exploring a shared project signals a shift from watching the space to actively shaping it.

Stablecoins are increasingly seen as faster, more transparent tools for things like cross-border payments, areas where traditional banking systems still face delays. Though regulation remains in flux, the interest from big banks shows these digital dollars are becoming harder to dismiss.

Now, both banks and crypto firms are eyeing the same ground: a future where compliance, speed, and scale are all on the table. Not a battle between old and new, but what seems like a meeting point.

Read all the other Digital Banking industry news below 👇 and I'll be back with more tomorrow!

Cheers,

Dominate the Payments Space! Subscribe to my Daily PayTech Newsletter for daily updates and trends in the evolving world of payment technology. Revolutionize your payments expertise today!

INSIGHTS

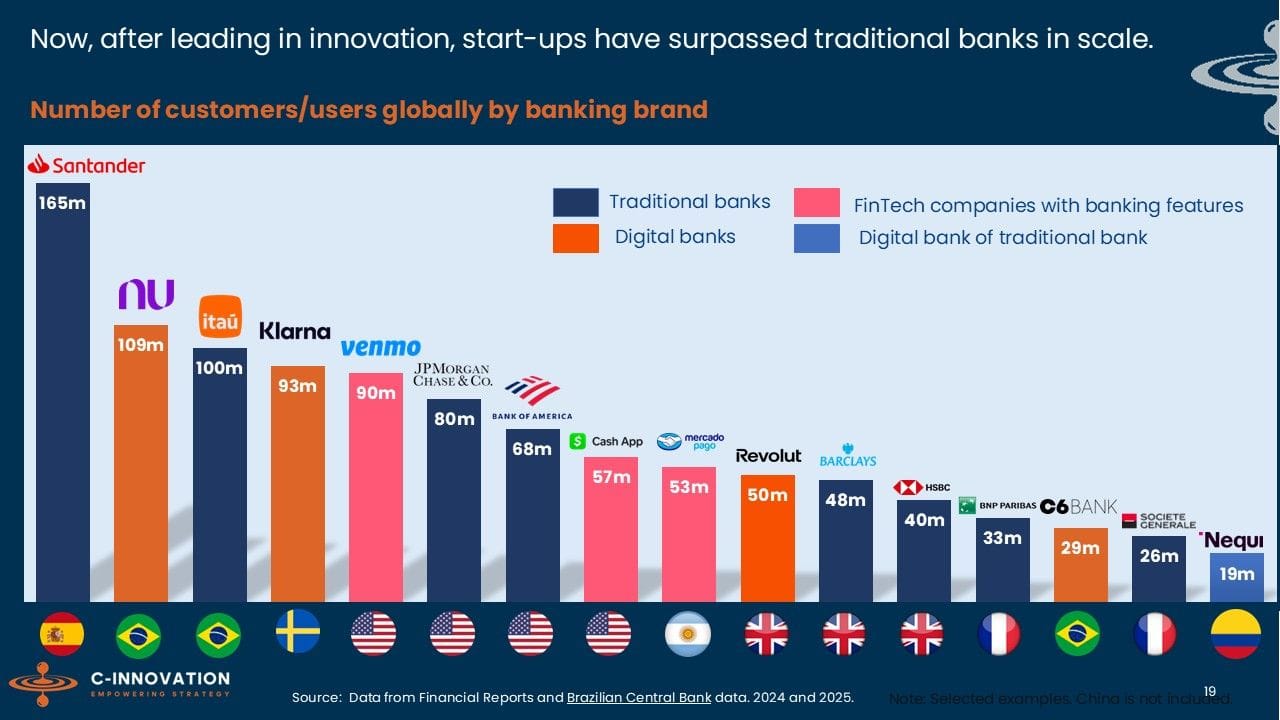

📊 Neobank "startups" have surpassed many traditional Banks in scale.

NEWS

🇺🇸 JPMorgan, Bank of America, Citigroup, and Wells Fargo explore a joint stablecoin project to challenge digital asset platforms. Discussions within the bank consortium are in early, conceptual stages and remain subject to change. Any final decision would depend on the fate of legislative actions around stablecoins and other factors.

🇺🇸 JPMorgan expands tech team with four veteran bankers from BofA, Goldman, Lazard. Mark Garcia, Eric Quanbeck, Brett Miller, and Peter Duda join as senior leaders in tech banking. They will be part of JPMorgan’s expanding technology investment banking division.

🌍 Orange is winding down its European retail banking operations and is in exclusive talks with Crédit Coopératif to sell its FinTech subsidiary, Anytime, which supports associations. This move aligns with Orange’s strategic exit and Crédit Coopératif’s 2030 growth plan.

🇦🇪 Emirates Development Bank launches Fee-Free Digital Banking Platform to support UAE entrepreneurs. From a single app, entrepreneurs will be able to manage payroll, invoicing, and payments, monitor cash flow, and access a growing suite of value-added services.

🌍 Quant makes money smarter with the rollout of industry-wide programmable money. Quant Flow, an industry programmable money and banking infrastructure now available via a white-label solution to banks, institutions, and corporates across Europe, the Middle East, and APAC.

🇮🇹 UniCredit escalates Banco BPM fight by taking Italy to court. The claim aims to address the legitimacy of the "golden power" under Italian and EU law, and UniCredit will support the EU's review of the situation. Read more

🇬🇧 Revolut joins new European payment wallet “Wero”. The British FinTech is not yet joining the "European Payments Initiative" (EPI), which is behind Wero, as a shareholder, but will very much become a "scheme member," meaning it plans to offer Wero as a payment solution to its customers soon.

🇨🇭 Revolut Business Chief James Gibson: We want to double our Swiss client base. Gibson outlined the neobank’s growth strategy, which includes new investments, enhanced foreign exchange tools, seamless onboarding processes, and the upcoming introduction of payment terminals for merchants, directly challenging the market dominance of Worldline.

🌎 Revolut’s CFD Trading launch led to Sergei Riabov's departure as head of Wealth & Trading after 3 years. His role included setting product strategy and overseeing operations across the UK, EU, and other international markets such as Singapore, Australia, and the US.

🇬🇧 FinTech Fiinu massively narrows annual losses and monthly burn rate. The company completed a £1.25 million equity raise in February and secured a £511,000 R&D tax credit in May 2025, extending its financial runway through at least mid-2026.

🇬🇧 UK FinTech MuchBetter partners with NatWest to launch business accounts through its new business banking offering, MuchBetter Business (MBB). NatWest will provide essential fund safeguarding, access to payment schemes, foreign exchange capabilities, and comprehensive banking support for its new B2B solution.

🇺🇸 Goldman Sachs hires Tommaso Ponselé for the new capital solutions team. He is joining the company as a managing director within its capital solutions unit. Goldman launched the unit in January as part of a new push to do more work with financial sponsors and do more work in the private credit space.

🇨🇳 Ant International launches tokenised deposit solutions for real-time treasury management with HSBC. The service will support treasury management with real-time, always-on HKD and USD payments between corporate wallets held by a corporate client at HSBC Hong Kong.

🇰🇿 Kazakhstan National Bank to regulate the crypto sector. The initiative falls in line with the President’s directive, with the financial institution and government agencies jointly developing a suite of legislative amendments specifically for creating a legal framework for digital asset turnover.

Want your message in front of 100.000+ Digital Banking fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.