Vivid Hits 50K Business Clients, Plans Card Acquiring & Treasury Interface

Hey Digital Banking Fanatic!

Two months ago, I highlighted in my FinTech Newsletter how Vivid Money had been gradually shifting its focus, from serving mostly individual customers to building a business banking platform. In 2022 started with freelancers, then moved into SME accounts last year.

At the time, they had around 30,000 business clients. Since then, the number has jumped to 50,000. That’s over 100 new businesses joining every day, and more than 3,000 each month.

To put that into perspective: Revolut, launched in 2017, has surpassed 500,000 business accounts. Monzo joined the space in 2020 and now holds 625,000. That averages out to roughly 5,200 per month for Revolut and 10,000 for Monzo, which, by the way, is pretty impressive 🤯. I haven’t looked closely at their early growth curves, but even without diving into the ramp-up phases, Vivid’s current momentum stands out.

The company says growth remains steady and expects to reach 75,000 business accounts by Q3 2025.

“We built Vivid for a new generation of entrepreneurs, fast, digital-first, and previously underserved by traditional banks,” said Co-founder Alexander Emeshev. In the German market, Vivid appears to be expanding faster than any other business banking platform.

Its product lineup has also grown in the last couple of months. They now have high-yield accounts, Smart Business Loans (with Banxware), a travel planning feature for expenses, and DATEV integration for accounting. But one feature stands out in particular: Europe’s first crypto staking account for SMEs.

With the MiCAR license in hand, Vivid is among the first in Europe officially authorized to offer regulated crypto services under the new EU rules.

What's next: card acquiring and a centralized treasury interface. Their goal is to make it easier for businesses to accept payments and manage liquidity in ETFs, money market funds, iBonds, and crypto.

Read all the other Digital Banking industry news below 👇 and I'll be back with more on Monday!

Cheers,

NEWS

🇩🇪 Vivid reaches 50,000 business customers and is ambitiously expanding. New features will be rolled out in the current quarter to further round out its product portfolio. These include a card-acquiring service that enables merchants and service providers to easily accept card payments.

🇰🇷 Kbank surpasses 14 million customers amid rapid growth. The firm explained that its growth has been driven by four core offerings: competitive refinancing loans, the "Plus Box" parking account, app-based earning services, and debit cards featuring popular character designs.

🇬🇧 UK’s digital bank OakNorth lends $20m to JV between Sabal Investment Holdings and 12 North Capital. The $20m loan will fund the acquisition of a non-performing loan secured against three Class A purpose-built memory care facilities in Leesburg and Warrenton, Virginia, and San Antonio, Texas.

🇵🇹 Revolut launches eSIMs and global data plans in Portugal. The eSIM allows customers to use the Revolut app without consuming their mobile data, facilitating access to all the app's products and features, even in places where there is no data coverage, highlights the FinTech.

🇺🇸 Chime prices IPO at $27 per share to raise $864 million. The company had marketed the offering between $24 and $26 per share. The IPO values Chime at roughly $11.6 billion on a fully diluted basis. It generates the bulk of its revenue from interchange fees.

🇺🇸 Bank of America’s Stablecoin play hinges on U.S. lawmakers’ next move. Lawmakers are working on a bill to regulate stablecoins. The GENIUS Act bill would set strong rules on how stablecoins should be backed and handled. It mandates that each stablecoin must be supported by real U.S. dollars or other assets that can be quickly sold.

🇺🇸 Carlyle teams up with Citi to invest in FinTech lenders. As part of the partnership, they will share market intelligence and explore co-investment and financing opportunities, the companies added. Continue reading

🇲🇳 Capitron Bank joins Thunes’ Direct Global Network to streamline payments in the Mongolian market. Customers will be able to send funds instantly across borders to bank accounts, mobile wallets, cards, and cash pick-up locations worldwide. With Mongolia’s export volumes experiencing double-digit growth, transactions continue to increase.

🇵🇰 Allied Bank, UnionPay, and Paysys partner to launch tokenized tap-and-pay in Pakistan. This collaboration empowers ABL customers. ABL will now offer tokenized mobile payment solutions that replace sensitive cardholder data with unique tokens, enhancing security while enabling faster transactions.

GOLDEN NUGGET

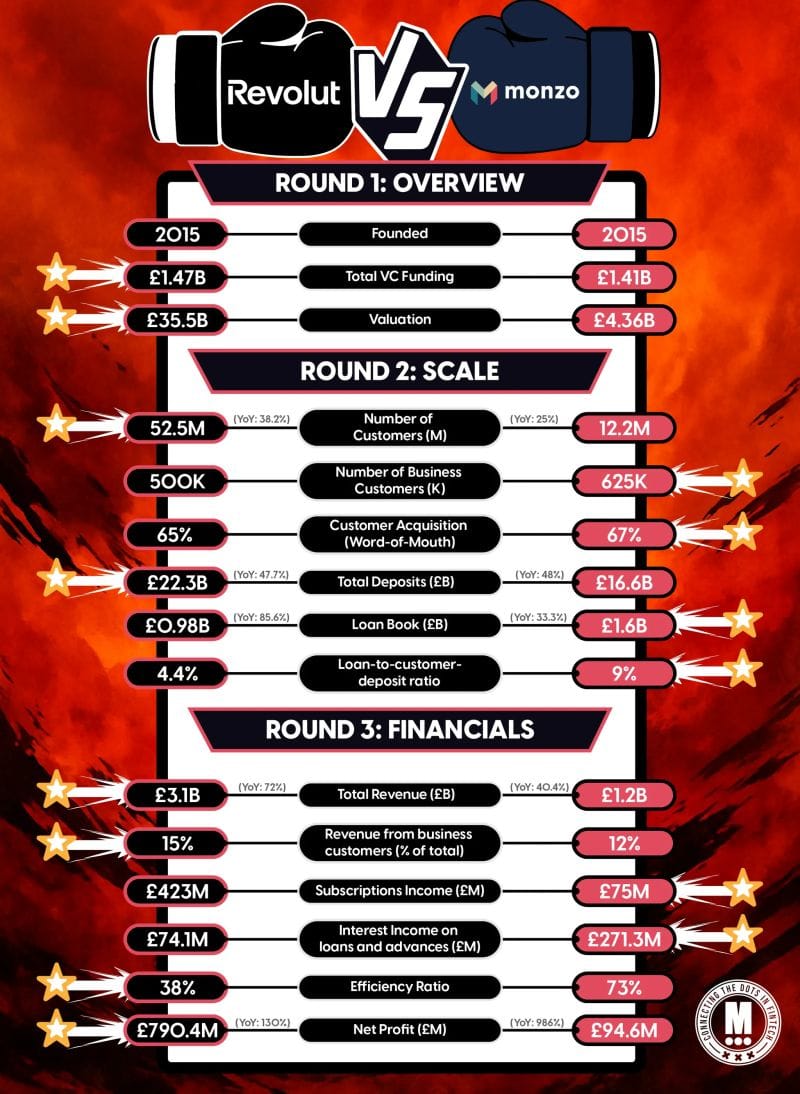

Revolut 🆚 Monzo Bank

Here is a comparison of 𝗞𝗲𝘆 𝗦𝘁𝗮𝘁𝘀:

Monzo published its FY2025 results last week:

Let’s take a look at how they stack up against Revolut’s 2024 accounts and compare their financial performance:

𝗥𝗲𝘃𝗼𝗹𝘂𝘁

Founded: 2015

CEO: Nik Storonsky

Total VC Funding: £1.47B

Valuation: £𝟯𝟱.𝟱𝗕

Number of Customers: 𝟱𝟮.𝟱𝗠 (YoY: +38.2%)

Number of Business Customers: 500K

Customer Acquisition via Word-of-Mouth: 65%

Total Deposits: £22.3B (YoY: +47.7%)

Loan Book: £0.98B (YoY: +85.6%)

Loan-to-Customer Deposit Ratio: 4.4%

💰 Financials

Total Revenue: £3.1B (YoY: +72%)

► Revenue from Business Customers: 15% of total

► Subscriptions Income: £423M

► Interest Income on Loans & Advances: £74.1M

► Efficiency Ratio: 38%

► Net Profit: £790.4M (YoY: +130%)

𝗠𝗼𝗻𝘇𝗼

Founded: 2015

CEO: TS Anil

Total VC Funding: £𝟭.𝟰𝟭𝗕

Valuation: £4.36B (as of Oct 11, 2024)

► Number of Customers: 𝟭𝟮.𝟮𝗠 (YoY: +25%)

► Number of Business Customers: 625K

► Customer Acquisition via Word-of-Mouth: 67%

► Total Deposits: £16.6B (YoY: +48%)

► Loan Book: £1.6B (YoY: +33.3%)

► Loan-to-Customer Deposit Ratio: 9%

💰 Financials

Total Revenue: £1.2B (YoY: +40.4%)

► Revenue from Business Customers: 12% of total

► Subscriptions Income: £75M

► Interest Income on Loans & Advances: £271.3M

► Efficiency Ratio: 73%

► Net Profit: £94.6M (YoY: +986%)

Looking at these numbers, what catches your eye the most?

I highly recommend reading more in the original complete newsletter.

Want your message in front of 100.000+ Digital Banking fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.