Wero Hits 44M Users in 12 Months – Now Eyeing E-Commerce

Hi Digital Banking Fanatic!

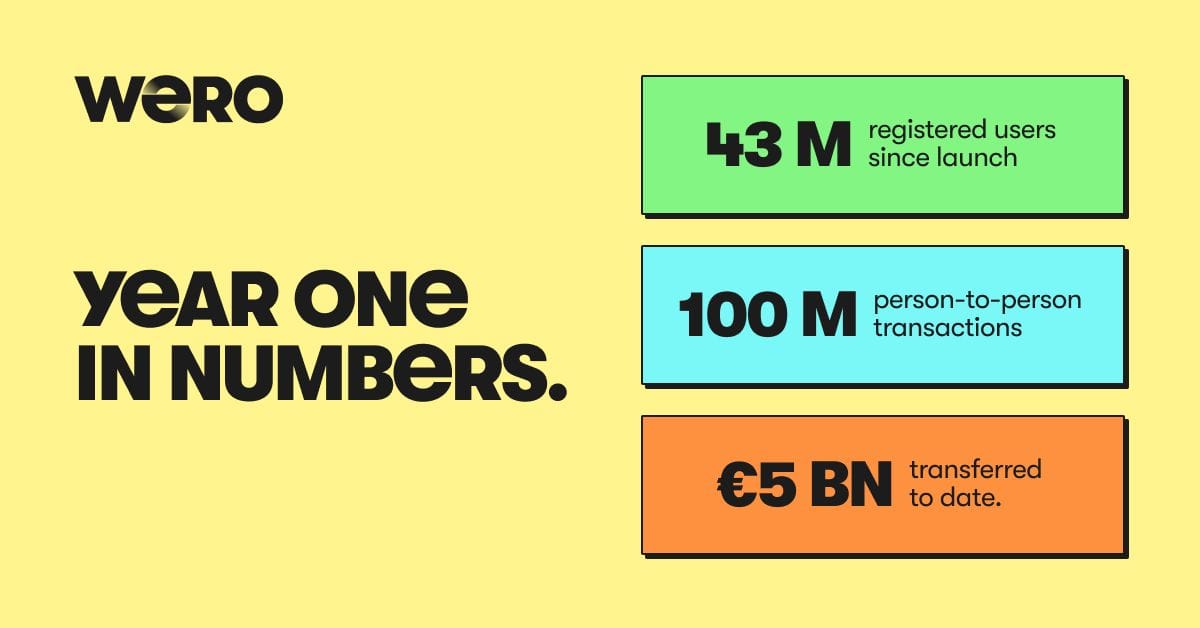

Twelve months. That’s all it took for Wero to go from launch to 44 million users across Europe 🤯.

Backed by a coalition of 16 banks and payment providers, the EPI-powered wallet has already processed over €7.5 billion in P2P transfers.

And they’re just getting started. Later this year, Wero is rolling out for e-commerce in Germany, with more countries, partners, and features—like in-store payments, subscriptions, and loyalty—already on the roadmap.

As CEO, Martina Weimert put it: This isn’t just another wallet, it’s a push for a sovereign, secure, and instant European payments solution.

The big question now: can Wero build the same momentum in online shopping as it did in P2P?

Cheers,

NEWS

📈 Wero digital wallet has become a trusted everyday payment solution for over 44 million Europeans 🤯 EPI Company is preparing to launch Wero for e-commerce, starting in Germany later this year.

🇧🇷 Getnet Appoints Caio Costa, Former PagBank, Visa, and Mastercard Executive, as VP of “Open Sales”. Getnet has announced the appointment of Caio Costa as its new Vice President of Open Sales. In this role, Costa will lead the company’s commercial strategy focused on acquiring clients through alternative sales channels.

🇫🇷 Revolut meets fiercest rival yet in French push. Revolut has now set up its EU base in Paris, promises to spend 1 billion euros in the next three years, and hopes to reach 10 million customers by 2027. Read more

🇬🇧 Zopa Bank sets out Manchester growth ambitions with Mayor Andy Burnham. The scaling of its Manchester location will support Zopa’s vision to become the home of money for its customers, creating effortless experiences and valuable products to build deeper relationships with customers.

🇺🇸 MoneyGram reinvents cross-border finance with next-generation App. Consumers who were once constrained by fragmented systems and local currencies will now be empowered to leverage stablecoins to access a fast and modern way to move and hold money across borders.

🇸🇦 MoneyGram and Enjaz partner to expand cross-border payments in Saudi Arabia. Through this collaboration, Enjaz will integrate MoneyGram’s global payments network infrastructure into its nationwide retail and digital channels, including the Enjaz Pay App, enabling millions of consumers to send money quickly and reliably. Additionally, MoneyGram and D360 Bank signed a strategic MoU at Money20/20 Middle East. The collaboration will focus on enhancing cross-border payment capabilities and delivering digital financial solutions to customers.

🇬🇧 Covecta raises $6.5M to speed up business lending with AI platform. The funds will help to expand its AI-powered platform, aiming to help banks automate workflows, accelerate lending, and free frontline staff from administrative burdens. Keep reading

🇵🇭 FinTech Salmon raises $50M in oversubscribed Nordic bond offering. The FinTech said the oversubscription reflects strong investor confidence in Salmon’s growth trajectory and financial performance and underscores demand for Southeast Asia’s emerging consumer lending platforms.

🌍 Tuum and Abwab.ai partner to deliver end-to-end SME lending solutions in the Middle East. The collaboration brings together Abwab.ai’s advanced AI-powered credit decisioning and analytics capabilities with Tuum’s modular. This integration enables financial institutions to rapidly launch, scale, and optimize SME lending offerings with greater efficiency, transparency, and speed.

🇮🇳 Paytm launches postpaid, a credit line on UPI, in partnership with Suryoday Small Finance Bank, offering ‘spend now, pay next month’ convenience. With Paytm Postpaid, consumers can now make payments using a credit line on UPI across all merchant touchpoints. This includes scanning any UPI QR code, shopping online, or paying for recharges, bill payments, and bookings on our app.

🇨🇭 Swiss banks complete first binding blockchain payment. In a milestone for the Swiss financial sector, UBS, PostFinance, and Sygnum have successfully executed the first legally binding interbank payment using tokenized bank deposits on a public blockchain.

Want your message in front of 100.000+ Digital Banking fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.