Wise Takes Steps Toward UK Banking

Hey Digital Banking Fanatic!

14 years after its launch, Wise is now in talks with regulators about becoming a UK bank. That shift could let it offer interest accounts and loans, services it cannot provide with its current licence.

For customers, it would also mean deposit protection of up to £85,000 through the Financial Services Compensation Scheme, bringing Wise closer to the safety net of traditional banks.

This comes after its US banking application earlier this summer, and now Wise finds itself waiting to become a bank. Is this a shift in strategy?

Will Wise face the same long wait as Revolut? What do you think? Let me know in the comments 👇

Cheers,

INSIGHTS

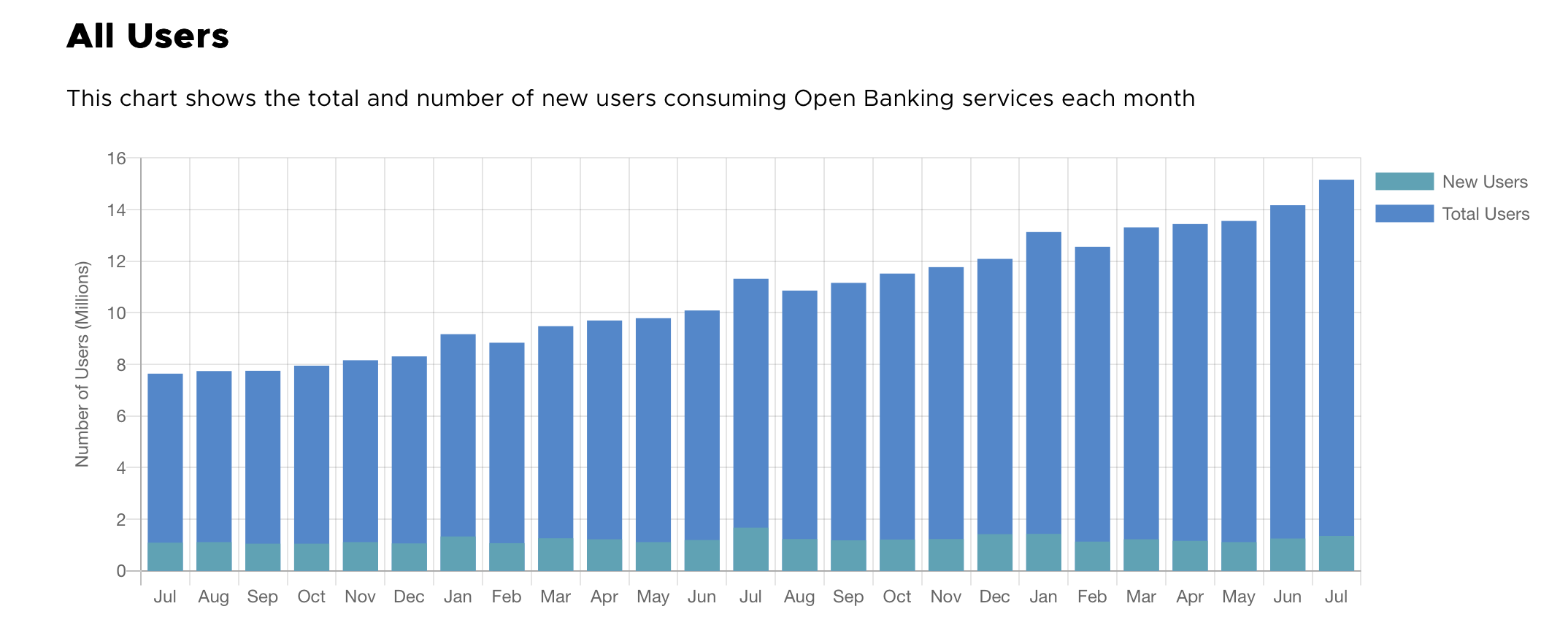

🇬🇧 Open Banking Surges to 15 Million UK Users as July Marks Record Adoption.

NEWS

🇬🇧 Wise is said to be exploring a UK banking license. If successful, the move will allow Wise to offer interest-bearing accounts and potentially issue loans, services currently off-limits under its existing electronic money licence. It would also bring the firm under the remit of the Financial Services Compensation Scheme, offering deposit protection up to £85,000 per customer.

🇬🇧 Revolut begins secondary share sale at $75 billion valuation. That secondary sale will value each share at $1,381.06, according to a memo. The company has already fielded demand for the sale from new and existing investors, the memo shows. The deal will solidify Revolut’s status as one of the most valuable FinTech companies globally.

🇮🇹 Revolut launches Duo in Italy: two paid plans and one low price. This new offering allows two customers to enjoy all the benefits of a Revolut plan at a reduced combined price, offering premium features while maintaining their own account autonomy.

🇿🇦 Nedbank readies public launch of MVNO platform. In an email interview, Ciko Thomas, group Managing Executive for Personal and Private Banking at Nedbank, says Nedbank Connect is currently available on the Money App and online banking, with a broader public launch scheduled for 15 September.

🇯🇵 Japan Post Bank to roll out tokenized deposits on DCJPY network by 2026. Under the plan, retail depositors will be able to exchange cash balances for DCJPY tokens, which can then be used to purchase tokenized securities targeting yields of 3% to 5%, according to the report.

🇸🇬 MariBank launches new in-app safeguards to combat phishing scams. These new security measures are to protect customers’ cards from increasingly sophisticated phishing scams involving digital wallets. Keep reading

🇨🇭 Ripple partner Amina Bank deepens Circle alliance ties to advance regulated stablecoins. Amina emphasized its intent to strengthen client confidence in stablecoin transactions, noting: “As Circle continues to lead the way in stablecoin utility, Amina enables individuals and institutions to transact with confidence across a global infrastructure. We’re proud to stand alongside Circle in this journey.”

🇮🇳 BharatPe and Unity Bank unveil new credit card. The card is available on the RuPay network and can be linked to UPI, allowing users to make payments across numerous merchants in India. It features a “zero-fee structure”, with no joining charges, annual fees, or processing charges, and customers can prepay their EMIs at any time without facing penalties.

🇰🇷 Korea’s Kbank partners with blockchain firm BPMG to launch cross-border stablecoin. The deal is for a blockchain wallet, platform development, and stablecoin consulting. Kbank has 14 million clients and is known as the partner bank for Upbit, the country’s largest cryptocurrency exchange.

🇵🇭 VBank taps Former Netbank Executive, Young Paul Raneses as COO and CPO. As both COO and CPO, Raneses will lead the bank’s product strategy, user experience design, platform innovation, and all end-to-end operations. This includes overseeing core banking processes, internal systems, service delivery, and customer support.

Want your message in front of 100.000+ Digital Banking fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.