ZA Bank Becomes Hong Kong’s First Digital Bank with 1M Users

Hi Digital Banking Fanatic!

ZA Bank just hit a milestone that no other Hong Kong digital bank has reached: 1 million customers.

The numbers behind that growth are equally impressive:

- Deposits climbed nearly 9% YoY to HK$21.1B

- Card transactions surged 33% (vs the market’s 8.4%)

- Total transaction volume, from remittances to FX, skyrocketed 132%

CEO Calvin Ng calls it “a new chapter,” and he’s betting big on wealth management + digital assets to keep the momentum rolling. With assets under management already up 125% this year, ZA is eyeing stock trading and expanded crypto offerings next.

Hong Kong’s FinTech race is heating up, and ZA just set the pace.

Cheers,

INSIGHTS

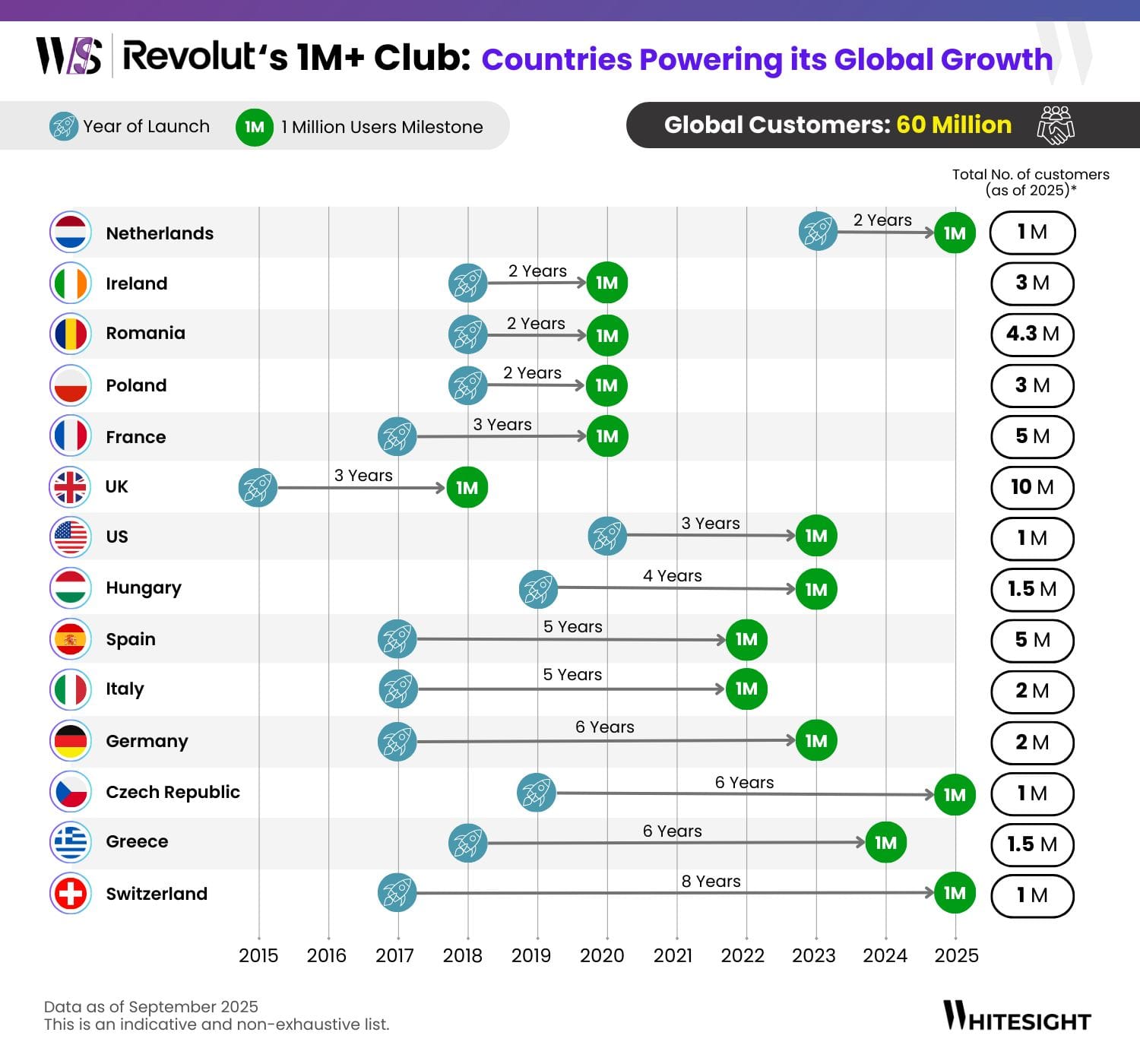

🌍 Revolut serves 60M+ customers across 48 countries, and the speed at which markets hit the 1M users mark reveals the engine behind its scale.

NEWS

🇨🇳 ZA Bank surpasses 1 million customers. The Hong Kong-based digital bank saw deposits and card transactions rise in H1. Total customer deposits rose 8.8% year-on-year to HK$21.1 billion by the end of the first half of the year. Card transactions jumped 33% YoY, above the market average of an 8.4% growth.

🇩🇪 Bling and Anio start a partnership. The collaboration between Bling and Anio is bringing a breath of fresh air to the mobile phone sector for children. With a focus on security and user-friendliness, the two companies have developed a special plan that offers parents reliable and controlled communication for their children.

🇬🇧 TPG leads funding for UK FinTech Tide at $1.5 billion valuation. The fresh funds will be allocated toward a new line of products, investments in AI, and further international expansion. Continue reading

🇪🇹 Siinqee Bank partners with Mastercard to launch prepaid cards, expanding digital payments in Ethiopia. By lowering barriers to entry, the partnership is expected to bring more Ethiopians into the financial system, enabling them to participate in global commerce, international travel, and online transactions.

🇶🇦 QNB enables Unified Payments Interface acceptance in Qatar. QNB has enabled the acceptance of QR code-based Unified Payments Interface (UPI) across Qatar via point-of-sale (POS) terminals for QNB’s merchant clients, powered by NETSTARS’ payment solution.

🇵🇰 LemFi secures State Bank of Pakistan approval. The approval enables LemFi to operate in partnership with United Bank Limited, one of Pakistan’s largest and most trusted financial institutions. Continue reading

🇵🇱 Revolut Bank already has 5 million customers in Poland. Becoming the bank of choice. This is a slogan that Revolut Bank consistently pursues in Poland. It already has over 5 million customers in the country. Keep reading

Want your message in front of 100.000+ Digital Banking fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.