Zopa Bank Doubles Profit to £34.2M, Eyes Expansion with New Current Account

Hey Digital Banking Fanatic!

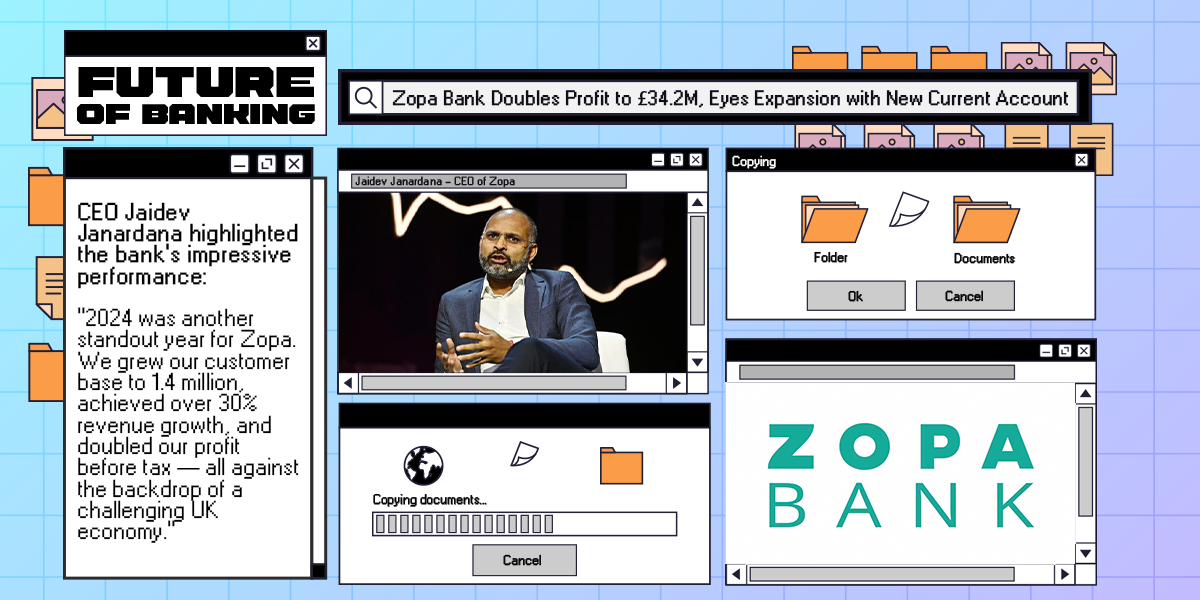

Zopa Bank has reported a significant financial achievement, doubling its pre-tax profit to £34.2 million for the fiscal year ending December 31, 2024. This marks the British digital bank's second consecutive year of profitability, underscoring its robust growth trajectory.

CEO Jaidev Janardana highlighted the bank's impressive performance: "2024 was another standout year for Zopa. We grew our customer base to 1.4 million, achieved over 30% revenue growth, and doubled our profit before tax — all against the backdrop of a challenging UK economy."

The bank's total revenue increased by 30.2% to £303.4 million, while its deposit base grew by 62.5% to £5.5 billion. Loans on the balance sheet rose by 16.2% to £3.1 billion. Zopa's customer base expanded by 28.1%, reaching 1.4 million. The bank maintained a cost-to-income ratio of 37.7% and achieved a Net Promoter Score (NPS) of 75, highlighting strong customer satisfaction.

Zopa's strategic partnerships with Octopus Energy and John Lewis have opened new avenues in the UK renewable energy market and expanded its personal loan offerings to John Lewis's 23 million customers.

Looking ahead, Zopa plans to launch its flagship current account, aiming to provide comprehensive financial solutions to its customers. The bank's focus remains on delivering products that offer real value and foster long-term customer relationships.

Read all the other Digital Banking industry news below 👇 and I'll be back with more on Monday!

Cheers,

Stay on top of FinTech trends. Subscribe to FOMO now and catch the week’s most important news and updates.

DIGITAL BANKING NEWS

🇺🇸 How to streamline banks’ payments as pathways proliferate. Payments orchestration centralizes traffic in a bank and sends it down the best path. As real-time payments and cross-border payments increase, setting up hubs will help banks keep up. Read the full article by Erich Litch from ACI Worldwide to learn more.

🇬🇧 Zopa Bank doubles full-year profit to £34.2 million. Its success has allowed the bank to reinvest profits at scale, fuelling a flywheel of sustained growth and innovation. By offering even greater customer value combined with seamless experiences, it drove deeper customer engagement and increased product adoption.

🇸🇬 Aspire partners with Episode Six to launch corporate card offering to SMBs in Hong Kong and Singapore. This collaboration strengthens Aspire’s financial solutions suite, providing its 50,000 SMB customers with powerful tools to optimize spending, improve security, and seamlessly manage international payments.

🇬🇧 Tandem posts 40% profit growth, underlining its status as the UK’s Greener Digital Bank. Tandem is now strongly positioned as one of the UK’s leading FinTechs, with award-winning savings products that offer consumers great rates designed to help homeowners and car buyers transition to a greener lifestyle.

🇬🇧 Standard Chartered joins the Temenos partner programme. Through the integration, financial institutions on the Temenos platform will benefit from a faster go-to-market in accessing StanChart’s extensive currency offering, allowing them to price services across more than 130 currencies and 5,000 currency pairs while managing exposure risks to FX market volatility.

🇬🇧 Revolut introduces Karma, a points-based system that tracks staff behavior and impacts bonuses, creating a feedback loop to encourage good practices. Meanwhile, Irish users have deposited nearly €1 billion in savings, with Revolut’s loan book in Ireland growing 54% in 2024 compared to 2023.

🇲🇳 FinTech LendMN raises USD 20 million to drive tech-led financial inclusion for MSMEs in Mongolia. For Lendable, investing in the Mongolian FinTech represents a strategic move and aligns with the company’s overall mission of bridging the financial inclusion gap by boosting accessible and inclusive financial services for all.

🇺🇸 US climate FinTech GreenFi launches with $17m seed funding. The capital injection will support the rollout of new financial products in "the coming months", including climate-conscious credit cards, green loans, expanded impact investment options, and higher-yield savings accounts.

🇺🇸 Ether.fi pivots to become a neobank and rolls out cash cards in the U.S. The ether.fi app will give users the experience of a traditional FinTech app, allowing them to spend, save, and earn money through linked crypto features, including restaking. The app will allow bill payments and payroll services using fiat money.

Want your message in front of 100.000+ Digital Banking fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.