Zopa Steps Into Current Accounts, Targets 5 Million Users in 3 Years

Hey Digital Banking Fanatic!

Zopa Bank, long associated with its lending products, is moving deeper into the current account market with the launch of Biscuit, a digital account offering cashback and savings interest rates above 7%, well above the Bank of England’s 4.25% base rate.

Founded as a P2P lender, Zopa secured its UK banking license in 2020 and has since grown to nearly 1.5 million customers across its savings and loan offerings.

The Biscuit account has been in development for over a year, tested by 80,000 users, and backed by a 90-person team. The bank is targeting average deposits of £1.5k to £2k per account and plans to grow its team further, particularly in compliance and risk.

“We would love to be serving more than 5 million customers in the next three to four years, growing to more than 10 million customers over a five to seven-year period,” said CEO Jaidev Janardana in an interview with Bloomberg News.

The move signals a broader strategy to expand its retail footprint and compete with larger digital banking players. Revolut now counts more than 10 million UK users, Monzo has reached 12 million, and Chase UK recently passed 2 million customers.

Read more Digital Banking updates below 👇 there'll be more tomorrow!

Cheers,

INSIGHTS

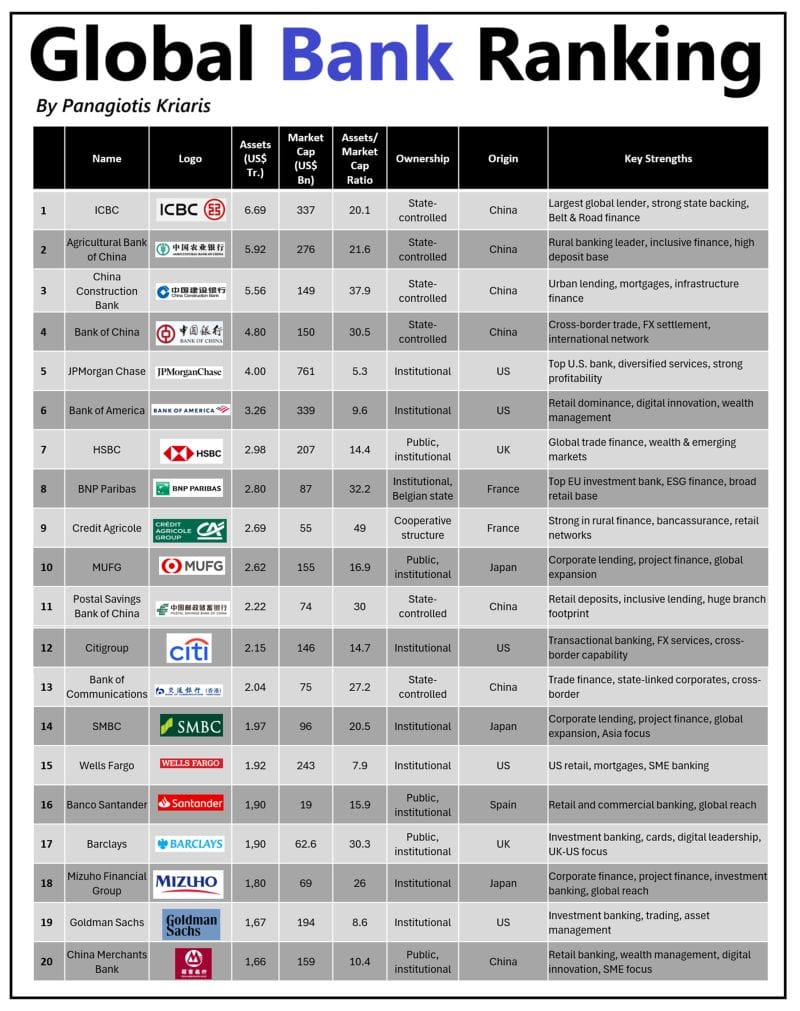

📈 Here's a Global Bank Ranking ranked by assets made by Panagiotis Kriaris.

NEWS

🇬🇧 Zopa launches current accounts to go toe-to-toe with Revolut. The bank aims to serve over 5 million customers in the next three to four years and over 10 million customers in five to seven years, targeting deposits of £1,500 to £2,000 per account.

🇬🇧 Zopa Bank partners with iVendi. The collaboration will enhance quoting and application processes for motor dealers currently working with Zopa Bank, while opening access to a broader network of potential introducers. Continue reading

🇺🇸 Goldman Sachs launches AI assistant firmwide. The GS AI assistant will help Goldman employees in summarising complex documents and drafting initial content, to perform data analysis, according to the internal memo. Goldman joins a long list of big banks already leveraging the technology to shape their operations.

🇨🇴 Nubank and Pibank are disrupting traditional Colombian banking in the credit and debit card segment. Nubank has entered the top tier of savings account providers, offering high interest rates up to around 11–13 % E.A. Meanwhile, Pibank has surged into the market with savings accounts yielding approximately 12 % E.A.

🇲🇽 Belvo and Ualá join forces to facilitate access to credit through employment data. This will allow Ualá to make immediate decisions without relying on information from credit reporting agencies. Read more

🇫🇷 Revolut hires Béatrice Cossa-Dumurgier as Western Europe CEO. As part of her new role, Béatrice will oversee the development of Revolut’s activities in Western Europe, with a key focus on securing the company’s banking licence from the French banking regulator, the Autorité de Contrôle Prudentiel et de Résolution (ACPR), and the European Central Bank (ECB).

🇬🇧 NAB hires Lloyds Bank's Pete Steel as inaugural digital, data and AI Chief. He will lead NAB's digital data and AI teams and initiatives, and be accountable for design, customer onboarding, and NAB's digital bank, Ubank. Keep reading

🇩🇪 Silverflow partners with Deutsche Bank for a European payments platform. The collaboration enabled the bank to minimise integration time as compared to legacy deployments, thus onboarding clients faster. This initiative demonstrated how modern payment infrastructure transforms banking operations.

🇱🇧 Bank Audi and Neo Digital Bank introduce Google Pay services in Lebanon. Customers can now add their Mastercard issued by Bank Audi or Neo to Google Wallet and use it for contactless payments at points of sale, as well as for online or in-app purchases both within Lebanon and abroad.

🇧🇩 Google Pay is now in Bangladesh with City Bank. Customers can add all their City Bank-issued Mastercard or Visa cards (both physical and virtual cards) to Google Wallet to make contactless payments with Google Pay. Continue reading

🇼🇸 ANZ launches instant payments. ANZ customers in Samoa can now send and receive instant payments following the bank’s integration with the Samoa Automated Transfer System (SATS). Keep reading

Want your message in front of 100.000+ Digital Banking fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.